IN THE FIRST half of 2013, when the global shipbuilding business continued to be bleak, many PRC shipyards failed to secure new orders, but one remained profitable: Yangzijiang Shipbuilding single-handedly accounted for half of the entire PRC shipbuilding sector's profit.

The shipyard posted 1H2013 net profit attributable to shareholders of Rmb 1.5 billion (down 19% year-on-year), on revenue of Rmb 7.3 billion (down 4% year-on-year).

This is half the Rmb 3.58 billion combined net profit generated by the 80 shipyards of competitive scale in China during the first 6 months of 2013, according to the China Association of National Shipbuilding Industries.The shipyard posted 1H2013 net profit attributable to shareholders of Rmb 1.5 billion (down 19% year-on-year), on revenue of Rmb 7.3 billion (down 4% year-on-year).

Yangzijiang's net margin was 20.8%, down 3.9 percentage points.

"We have one of the highest net margins among shipyards all over the world because of prudent use of our cash reserves,? said executive chairman Ren Yuanlin during a media briefing at its office at 6 Battery Road on Wednesday.

The company's shipbuilding revenue remained unchanged at Rmb 6.5 billion (up 0.1%).

'We are looking into building LPG vessels and larger containerships,' said executive chairman Ren Yuanlin at its media briefing.

'We are looking into building LPG vessels and larger containerships,' said executive chairman Ren Yuanlin at its media briefing.Company file photo1H2013 group revenue was boosted by a 14.9% increase from its investment segment to Rmb 778.2 million. This segment comprises of interest income from financial assets, held-to-maturity products and micro financing.

?Banks are willing to lend to us at very low interest rates of as low as 3.3%. If we don't have such a large shipbuilding asset as well as huge cash reserves, banks will not offer us such preferential interest rates.

"We use our excess funds in financial management products, which include loans to other companies arranged by the banks," said Mr Ren.

?We have 3 criteria for financial management products: strong collateral, low credit risk, and yields that exceed bank financing. Return on funds is not as high as in shipbuilding, but it is a stable income stream with much lower risk.

?Such a business model allows us to have a higher net margin.?

Details of its 1H2013 financial results are available in its media release.

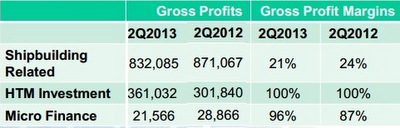

Where Yangzijiang derived its 2Q gross profits from.Below is a summary of Mr Ren?s replies to media queries during the briefing.

Where Yangzijiang derived its 2Q gross profits from.Below is a summary of Mr Ren?s replies to media queries during the briefing.Q: Do you only have one jack-up rig order?

We are in talks with several parties who want to place orders for jack-up rigs, but we have not accepted any orders because of the payment terms offered: down payment of only 5% on contract value. We want a 5% downpayment on signing the agreement, and another 5% on steel cutting, but they couldn't raise money for this. Our first jackup order had a 10% downpayment and we will not accept downpayment of less than 10%.

CFO Liu Hua.

CFO Liu Hua.NextInsight file photoMost Chinese yards are offering to construct oil rigs with only 2% to 5% downpayment. On the other hand, established offshore engineering yards in Singapore require a downpayment of 20% to 25%.

Chinese yards need to venture into offshore marine for expansion. However, the oil rig market is very small, unlike the bulk carrier or containership markets. We require two conditions as we enter the oilrig market: low-risk and visibility of profit.

Q: Are you concerned about competitors getting ahead when you are so selective?

We prefer to have a good track record on our first oil rig and build up a good reputation. This is more important compared to getting more orders. We also want to build up a strong offshore engineering team through a good experience in our offfshore projects. We have been through many shipbuilding cycles and will not rush into this.

Q: What is your revenue target for offshore engineering?

Q: What is your revenue target for offshore engineering?Our long-term target is for offshore engineering to contribute 20% of shipbuilding revenue.

Q: What's the bulk carrier market like currently?New bulk carriers are profitable even with Baltic Dry Index levels at as low as 1200 as they are 20% more fuel-efficient than older models. On the other hand, the old bulk carriers cannot make money even if the BDI is at 2000. The new bulk carrier fleet will be launched only in 2016, so we still have opportunity to secure orders for new bulk carrier models.

Q: Why are you rolling out dual-currency trading at this point?

China is taking steps to make the RMB convertible globally and Singapore wants to be a RMB currency exchange hub. Against this background, SGX is trying to roll out more RMB-traded instruments. I like to lead the market. We were the first state-owned shipyard to be privatized. We were the first PRC yard to list in Singapore and the first PRC company to list in Taiwan. It?s good to be part of new developments that benefit society.

Q: What differentiates YZJ from other Chinese yards?

We have a history of more than 5 decades. As a former state-owned enterprise (SOE), we have in place a strong management team. We also have a very good corporate strategy.

As a private enterprise, one corporate culture we have is: Reward people by results and not by behavior. Employees do not need to look to each other to measure progress. And we give tangible rewards to those who perform. Our employees own shares in the company. We have a dividend yield that is higher than bank deposits and pension funds.

We have the strengths of a SOE as well as a private enterprise.

No comments:

Post a Comment