世界各地,發生着太多的金融和其他大事件,人們議論紛紛,妄下結論;可惜,大多數人都錯過了重點,鮮有人能看清事實的全貌。因此,乾脆把他們的意見拋諸腦後!其實,比起專家,你一點也不愚昧,你是地球上最精明的一群!

勿跟風炒賣

投資市場前景不明朗,假如你選擇將錢放在銀行,固然無傷大雅。不過,如果你真的想投資,我會很敬佩你;通往財務自由的道路充滿顛簸,果敢的你定會成為終極贏家!記住,數字很難說謊,一間公司的財政狀況罕有能瞞騙所有人!這是你的投資聖經,長遠而言,其他東西都是次要。

首先,你必須避開一窩蜂的炒賣狂熱,蘋果電腦便是一例!其股價已由每股七百美元,插水至三百九十美元。儘管如此,蘋果電腦仍然是全球第二大市值的企業!同時,請你幫自己一個忙,不要炒賣貨幣,即使是專家也經常「睇錯市」;況且,不久的將來,會爆發一場貨幣戰爭,局勢千變萬化。對於你一無所知的投資產品,更要敬而遠之,好似交易所買賣基金﹙ ETF﹚、商品、黃金、白銀、期貨或窩輪。如果他們有做槓桿,一旦插水,你可能一鋪清袋!

最後,不要借錢投資!

換馬港機工程

至於股票,當然要做足功課。本倉成分股可以做你投資的藍本,事關這些公司之所以「入圍」,事前都做足研究,其資產負債表皆擁有 AAA評級。業績期剛過,一如我所料,假如你撇除一次性收入,香港及中國股票去年的核心盈利令人失望。

中石油的表現更是個謎。過去數年,油價收復了不少失地,中石油卻未能從中受惠。歸根到底,中石油被迫以「蝕本價」出售產品,如汽油,以補貼居民。面對政府這個巨人,我節節敗退,所以決定「變陣」,沽出中石油,買入港機工程。

港機工程是一間質素甚高,管理優良的飛機維修服務供應商,大股東太古集團持有七成五權益。飛機維修是一行門檻極高的行業,但港機工程早前卻因禽流感被投資者大手沽售。這場疫症或者會打擊旅遊業,但斷不會永久!如果你想成為一名看長線的價值投資者,必須在別人「不理好醜」把股票賣掉時,買入優質股。

我確信,有許多上市公司都是「生人勿近」,原因諸如管理質素差、賬目造假、負債高企。但不能「一竹篙打一船人」,我有信心,市場終有一天會明白這點,對優質股另眼相看!

Socrates: Where are you ? Millman: Here............ Socrates: What time is it ? Millman: Now.......... Socrates: What are you ? Millman: This moment.

Sunday, April 28, 2013

Wednesday, April 24, 2013

NOTICE OF BOOK CLOSURE AND DIVIDEND PAYMENT DATE

NOTICE IS HEREBY GIVEN that, subject to the approval of the shareholders of the Company to the proposed final dividend at the Annual General Meeting to be held on 26 April 2013, the Share Transfer Books and Register of Members of the Company will be closed on 13 May 2013 for the purpose of determining entitlements of ordinary shareholders to the tax exempt (one-tier) final dividend of S$0.05 per ordinary share (the “Final Dividend”) in respect of the financial year ended 31 December 2012.

Duly completed registrable transfers received by the Company’s Share Registrar, Boardroom

Corporate & Advisory Services Pte. Ltd. at 50 Raffles Place, #32-01 Singapore Land Tower, Singapore 048623, up to 5.00 p.m. on 10 May 2013 will be registered before

entitlements to the Final Dividends are determined.

entitlements to the Final Dividends are determined.

Members whose securities accounts with The Central Depository (Pte) Limited are credited with the Company’s ordinary shares as at 5.00 p.m. on 10 May 2013 will be entitled to the Final

Dividend.

Payment of the Final Dividend, if approved by the members at the Annual General Meeting, will

be made on 21 May 2013.

By Order of the Board

Ren Yuanlin

23 April 2013

Sunday, April 21, 2013

王澤基教授 ACPE介紹 3

王澤基教授方法: 用 三年 ACPE (ADJUSTED CYCLIC PE)

恆生指數 三年 ACPE (ADJUSTED CYCLIC PE) =13下注 70%,買2800.hk

若再跌ACPE (ADJUSTED CYCLIC PE) =10下注 30%,買2800.hk

以後 ACPE (ADJUS ...

注意是用

HSI 三年 ACPE (ADJUSTED CYCLIC PE)

把過去 3 年 HSI 獲利 的$, 加起來 除以三, = 1447.3

再乘 13 = 18814.9

(本波未跌到 ACPE =10 --->14473), HSI 就反彈了

(此方法 可下大單, 不會害怕, 不必看盤, 適合 上班族, AND 適合像我 --選股白痴, 不必研究公司基本面.....

產業分析.............. )

恆生指數 三年 ACPE (ADJUSTED CYCLIC PE) =13下注 70%,買2800.hk

若再跌ACPE (ADJUSTED CYCLIC PE) =10下注 30%,買2800.hk

以後 ACPE (ADJUS ...

注意是用

HSI 三年 ACPE (ADJUSTED CYCLIC PE)

把過去 3 年 HSI 獲利 的$, 加起來 除以三, = 1447.3

再乘 13 = 18814.9

(本波未跌到 ACPE =10 --->14473), HSI 就反彈了

(此方法 可下大單, 不會害怕, 不必看盤, 適合 上班族, AND 適合像我 --選股白痴, 不必研究公司基本面.....

產業分析.............. )

寧可錯過不可做錯 金融教授王澤基 投資第一守則

面前的王澤基是「70後」,受業於英國牛津大學經濟系,屬精英一族。他曾經在搵錢至上的國際投資銀行如高盛、瑞銀、巴克萊等打滾10年,近年才毅然放棄高薪要職,到中文大學執教鞭。

從金融才俊到大學教授,王澤基直言如欲投資賺錢,第一件事是學識不要輸錢,只會在「贏面高過輸面」下才作投資決定。他的投資生涯中只買期權,從不買個別股,並要等到最極端的時機才入巿,相信寧可錯過,不可做錯,贏面就大。 採訪:李如虹

於1998年還是牛津精英的王澤基,一邊唸博士學位,一邊在當地瑞銀(UBS)做兼職。王澤基因主修經濟及工程數學,於是選擇了銷售債券,和按揭抵押證券(CDO)的定息產品(Fixed Income, Currency and Commodities)作為入台階。當年,這些投資產品仍十分冷門,但從事者年薪卻有5萬至6萬英鎊,加上1萬至2萬鎊分紅,羡煞不少年輕留學生。

轉捩點是科網股爆破後,瑞銀英倫辦公室變得十室九空,CDO又霎時變了新興業務。王澤基是避過公司裁員潮的員工之一,於是臨危受命,為公司擔大旗策劃CDO業務,並因此而火速上位。

從不沾手個別股份

在倫敦浸淫6年,他於2006年被公司調派返港任執行董事,每天為客戶作大手交易外,私下的他卻並非大炒家。王澤基坦言,賺錢的方法好少,輸錢的方法卻好多,自己一生從未買過個別股份,理由是一間公司的業務運作十分複雜,不易了解,因此不理解就不要沾手。王澤基說:「眼見有些超過30倍市盈率的股份,大多純粹炒作,至於5至6倍則買得過,守5年可以有很好的回報。我只喜歡做一些合理的投資。」

他指合理的投資就是無論如何去盤算,最終不會輸得太離譜的情況才下手。王澤基補充,「太離譜」的定義,是假設在最差的投資環境下,個人能夠承受風險的底線:「以100元買股票,要預計會輸掉全部本金,而這風險,一定是自己能夠承受的。」

最極端環境才入巿

他自言一生在投資場上的贏輸比率是6比4,連賭場贏錢的機會率(5.1比4.9)都沒有那麼大。他總結經驗時說:「要看賭幾多局,我覺得長賭會贏。在賭局中,劣勢時要博,優勢時要穩。」

王澤基直言想投資賺錢,第一件事是學識不要輸錢。這老生常談,知易行難。他說:「輸完最緊要有得翻本,也要可以執番身彩。」故此他不會把超過10%個人資產,放在同一投資工具上。王澤基說從不借貸投資,因為槓桿是兩面鏡,可以放大贏輸面,沒有債務,就算輸清光都心裏有數。

就好像他只買期權,培養出等待的能耐,靜候最極端的環境下才入巿。他舉例說,以往曾在恒指低開11,000點買認購期權(Call Options),於3萬點高開買認沽期權(Put Options)。他說投資必須要有紀律,即寧可錯過,不可做錯,贏面就大。

王澤基坦言也有投資損手的時候,例如在1997年買期指,恒指越買Put越升,結果輸掉10%個人資產。

他表示,任你多聰明多嚴謹,總會有出錯機會。普羅投資者的想法,是說服自己所做的事是對的,但人總會有高估自己的時候。

從金融才俊到大學教授,王澤基直言如欲投資賺錢,第一件事是學識不要輸錢,只會在「贏面高過輸面」下才作投資決定。他的投資生涯中只買期權,從不買個別股,並要等到最極端的時機才入巿,相信寧可錯過,不可做錯,贏面就大。 採訪:李如虹

於1998年還是牛津精英的王澤基,一邊唸博士學位,一邊在當地瑞銀(UBS)做兼職。王澤基因主修經濟及工程數學,於是選擇了銷售債券,和按揭抵押證券(CDO)的定息產品(Fixed Income, Currency and Commodities)作為入台階。當年,這些投資產品仍十分冷門,但從事者年薪卻有5萬至6萬英鎊,加上1萬至2萬鎊分紅,羡煞不少年輕留學生。

轉捩點是科網股爆破後,瑞銀英倫辦公室變得十室九空,CDO又霎時變了新興業務。王澤基是避過公司裁員潮的員工之一,於是臨危受命,為公司擔大旗策劃CDO業務,並因此而火速上位。

從不沾手個別股份

在倫敦浸淫6年,他於2006年被公司調派返港任執行董事,每天為客戶作大手交易外,私下的他卻並非大炒家。王澤基坦言,賺錢的方法好少,輸錢的方法卻好多,自己一生從未買過個別股份,理由是一間公司的業務運作十分複雜,不易了解,因此不理解就不要沾手。王澤基說:「眼見有些超過30倍市盈率的股份,大多純粹炒作,至於5至6倍則買得過,守5年可以有很好的回報。我只喜歡做一些合理的投資。」

他指合理的投資就是無論如何去盤算,最終不會輸得太離譜的情況才下手。王澤基補充,「太離譜」的定義,是假設在最差的投資環境下,個人能夠承受風險的底線:「以100元買股票,要預計會輸掉全部本金,而這風險,一定是自己能夠承受的。」

最極端環境才入巿

他自言一生在投資場上的贏輸比率是6比4,連賭場贏錢的機會率(5.1比4.9)都沒有那麼大。他總結經驗時說:「要看賭幾多局,我覺得長賭會贏。在賭局中,劣勢時要博,優勢時要穩。」

王澤基直言想投資賺錢,第一件事是學識不要輸錢。這老生常談,知易行難。他說:「輸完最緊要有得翻本,也要可以執番身彩。」故此他不會把超過10%個人資產,放在同一投資工具上。王澤基說從不借貸投資,因為槓桿是兩面鏡,可以放大贏輸面,沒有債務,就算輸清光都心裏有數。

就好像他只買期權,培養出等待的能耐,靜候最極端的環境下才入巿。他舉例說,以往曾在恒指低開11,000點買認購期權(Call Options),於3萬點高開買認沽期權(Put Options)。他說投資必須要有紀律,即寧可錯過,不可做錯,贏面就大。

王澤基坦言也有投資損手的時候,例如在1997年買期指,恒指越買Put越升,結果輸掉10%個人資產。

他表示,任你多聰明多嚴謹,總會有出錯機會。普羅投資者的想法,是說服自己所做的事是對的,但人總會有高估自己的時候。

大時代局勢將出現

昨日早段市況反覆,午後更一度試衝高位,但到了下午3時後,期指沽盤拖累大市急跌,尾市的跌勢其實頗為凶險,期指僅險守21500關口。這樣的情況確實磨蝕了好友的信心,有貨者皆變驚弓之鳥,難以安心。

現時的市況確實難搞,成交萎縮,市場信心薄弱。過了4月,又有人會提「五窮六絕」、Sell in May等講法,現階段惟有捱住先,等待市場出現轉勢的一刻。

睇番外圍,日圓繼續弱,歐洲縱使數據欠佳,歐元卻強勢持續,理論上港股不應弱不禁風。內地股市尚且能夠企穩,究竟這是殺倉還是別有原委,估計這兩天自有分曉。

靜待轉勢訊號

就算是去年因歐債問題而令恒指跌至18000點,也不會像今次這般摸不着頭腦。經驗告訴自己,這應該是「大時代」局勢出現的先兆。大上還是大落?確實是耐性及信心的考驗。

筆者此刻的策略,仍是要留有一手,等待市況轉勢的確認訊號,暫不宜操之過急。

今次的跌浪,最奇怪的一個訊號,就是期指未平倉合約持續收縮,但又未見期權方面出現顯著的加倉。另一方面,牛熊證的成交及街貨量,亦較過往為少,完全睇不到衍生工具市場的手影。前日只見到於21600 put加1,716張,但22000 put減1,272張,理論上是22000 put食糊,但會是轉去21600 put長倉定短倉,則未可確定。既然未睇得通,還是不變應萬變為上。

個股方面,內房股走勢較強,可能市場見早前公佈的GDP較預期差,憧憬內地對樓市的政策不會收緊,開始趁低吸納。內地樓市確實有剛性需求,若沒有政策因素,內房股現水平是值得吸納的。

現時的市況確實難搞,成交萎縮,市場信心薄弱。過了4月,又有人會提「五窮六絕」、Sell in May等講法,現階段惟有捱住先,等待市場出現轉勢的一刻。

睇番外圍,日圓繼續弱,歐洲縱使數據欠佳,歐元卻強勢持續,理論上港股不應弱不禁風。內地股市尚且能夠企穩,究竟這是殺倉還是別有原委,估計這兩天自有分曉。

靜待轉勢訊號

就算是去年因歐債問題而令恒指跌至18000點,也不會像今次這般摸不着頭腦。經驗告訴自己,這應該是「大時代」局勢出現的先兆。大上還是大落?確實是耐性及信心的考驗。

筆者此刻的策略,仍是要留有一手,等待市況轉勢的確認訊號,暫不宜操之過急。

今次的跌浪,最奇怪的一個訊號,就是期指未平倉合約持續收縮,但又未見期權方面出現顯著的加倉。另一方面,牛熊證的成交及街貨量,亦較過往為少,完全睇不到衍生工具市場的手影。前日只見到於21600 put加1,716張,但22000 put減1,272張,理論上是22000 put食糊,但會是轉去21600 put長倉定短倉,則未可確定。既然未睇得通,還是不變應萬變為上。

個股方面,內房股走勢較強,可能市場見早前公佈的GDP較預期差,憧憬內地對樓市的政策不會收緊,開始趁低吸納。內地樓市確實有剛性需求,若沒有政策因素,內房股現水平是值得吸納的。

南韓重拳 刺激經濟

南韓已經連續七季經濟增長不足 1%,政府 3 月已明言,將推出刺激經濟措施,還向央行施壓,要求央行減息及購買更多國債。南韓央行至今雖然未見甚麼重大動作,但政府照樣推出總值 154 億美元的方案,致力挽救深受日本威脅的經濟。

僅次於 98 年亞洲金融風暴及 08 年金融危機,南韓政府祭出歷來第三大規模的刺激方案,說明今次經濟危機,足以媲美對上兩次危機。相比之下,日本採用貨幣政策手段,南韓政府則透過擴張財政政策,增加 17.3 萬億韓圜(約 154 億美元)補充預算,希望推動今年經濟增長 0.3 個百分點至 3.3%。

由於經濟增速緩慢,稅收比預期少 6 萬億韓圜,南韓政府推遲出售兩間國營銀行的股權,亦令庫房收入減少。南韓政府打算在補充預算中撥出 12 萬億韓圜用來填補收入缺口;振興經濟方面,實際可用預算為 5.3 萬億韓圜,主要用於支援中小型出口商、資助創業,增聘公務員等,冀創造 4 萬個就業職位。當然少不了的是,增加基建工程的投資。

南韓政府指,刺激方案的資金乃透過增加發債及調整國債回購計劃所得。增加預算後, 南韓政府今年的財赤相對GDP的水平將會由 0.3% 上升至 1.8%;債務相對 GDP 則將由 34.8% 上升至 36.2%。在已發展國家的水平而言,尚算健康。

以往南韓的經濟政策側向大企業,三星、現代等富可敵國的企業,一直是南韓經濟之柱。不過,金融危機後,縱使大型企業的生產率、市場佔有率皆有所提升,但他們於南韓國內的雇用比例卻由 18% 降至 12%。相反,中小型製造業更能提升就業率,對經濟的貢獻更大。南韓新總統樸槿惠早前已表示,要幫助中小企成為推動經濟成長的重要一環。

日本透過壓低匯率來提升出口競爭力,受多方指責,痛罵聲中少不了南韓聲音。日圓貶值,使各出口國的製造業雪上加霜。由於南韓主要產業又與日本相近,有分析指,萬一日圓貶值至 1 美元兌 100 日圓水平,將令南韓的半導體、鋼鐵、石化、機械、通訊及汽車等行業步入衰退。 所以,南韓政府要及早落藥。

南韓政府近期連環出招,2 月樓市交投減少 14%,創七年新低,首爾樓價亦跌至 08 年低位,迫使政府於 4 月初推出買屋減稅優惠,更額外動用國家基金約 2 萬億韓圜,助國民融資租樓、買樓,為處於一潭死水的樓市製造一點漣漪。央行上周又降低貸款息率,同時把銀行低息貸款規模上限, 由9萬億韓圜上調至 12 萬億韓圜,鼓勵企業融資。這套「先救樓市,繼而助企業融資,現在更出動大規模擴張式財政政策」的大計,無非為安撫民心,鞏固新政府的威信。對經濟果效是否如此顯著?且拭目以待。

僅次於 98 年亞洲金融風暴及 08 年金融危機,南韓政府祭出歷來第三大規模的刺激方案,說明今次經濟危機,足以媲美對上兩次危機。相比之下,日本採用貨幣政策手段,南韓政府則透過擴張財政政策,增加 17.3 萬億韓圜(約 154 億美元)補充預算,希望推動今年經濟增長 0.3 個百分點至 3.3%。

由於經濟增速緩慢,稅收比預期少 6 萬億韓圜,南韓政府推遲出售兩間國營銀行的股權,亦令庫房收入減少。南韓政府打算在補充預算中撥出 12 萬億韓圜用來填補收入缺口;振興經濟方面,實際可用預算為 5.3 萬億韓圜,主要用於支援中小型出口商、資助創業,增聘公務員等,冀創造 4 萬個就業職位。當然少不了的是,增加基建工程的投資。

南韓政府指,刺激方案的資金乃透過增加發債及調整國債回購計劃所得。增加預算後, 南韓政府今年的財赤相對GDP的水平將會由 0.3% 上升至 1.8%;債務相對 GDP 則將由 34.8% 上升至 36.2%。在已發展國家的水平而言,尚算健康。

以往南韓的經濟政策側向大企業,三星、現代等富可敵國的企業,一直是南韓經濟之柱。不過,金融危機後,縱使大型企業的生產率、市場佔有率皆有所提升,但他們於南韓國內的雇用比例卻由 18% 降至 12%。相反,中小型製造業更能提升就業率,對經濟的貢獻更大。南韓新總統樸槿惠早前已表示,要幫助中小企成為推動經濟成長的重要一環。

日本透過壓低匯率來提升出口競爭力,受多方指責,痛罵聲中少不了南韓聲音。日圓貶值,使各出口國的製造業雪上加霜。由於南韓主要產業又與日本相近,有分析指,萬一日圓貶值至 1 美元兌 100 日圓水平,將令南韓的半導體、鋼鐵、石化、機械、通訊及汽車等行業步入衰退。 所以,南韓政府要及早落藥。

南韓政府近期連環出招,2 月樓市交投減少 14%,創七年新低,首爾樓價亦跌至 08 年低位,迫使政府於 4 月初推出買屋減稅優惠,更額外動用國家基金約 2 萬億韓圜,助國民融資租樓、買樓,為處於一潭死水的樓市製造一點漣漪。央行上周又降低貸款息率,同時把銀行低息貸款規模上限, 由9萬億韓圜上調至 12 萬億韓圜,鼓勵企業融資。這套「先救樓市,繼而助企業融資,現在更出動大規模擴張式財政政策」的大計,無非為安撫民心,鞏固新政府的威信。對經濟果效是否如此顯著?且拭目以待。

商品大跌 鴿派佳音

金價大跌,不僅投資者損手,連持有大量黃金儲備的各大小央行亦無一倖免。世界黃金協會估計,全球央行持有的黃金儲備總值,今年已經累計蒸發掉 5,600 億美元,折合約 43,680 億港元。

不過,許多新興市場國家的央行,仍然對持有黃金充滿信心。其中,南非央行表示,無意改變儲備中黃金的比重;南韓央行更認為金價下跌其實沒甚麼大不了,黃金儲備是央行的長遠策略,不會輕易改變;至於斯里蘭卡央行更表示,目前是進一步吸納黃金儲備的大好機會。

央行雖然因為金價大跌令儲備價值萎縮,但某些央行官員反而因為商品價格大跌而感到無比欣慰,尤其是那些一直主張繼續無限 QE(量寬),但又不斷遭各方以通脹威脅逼近為由責難的央行官員。今回這群「超級鴿」終於可以吐氣揚眉了。

當市場開始相信全球暫無通脹威脅,主張繼續寬鬆政策的央行鴿派,自然有大條道理堅持不退市。本周四、五,華盛頓將一連兩日召開 G20 財長與央行行長會議,美、英、歐、日四大央行本來是眾矢之的,被指濫印銀紙,在全球製造資產泡沫與通脹。碰巧商品價格全線向下,大大紓緩了通脹壓力,已令有關指控化解於無形。

當市場的通脹預期回落,四大央行今後將更肆無忌憚加碼「放水」,無限 QE、QE 無限相信仍會繼續。美、英、歐、日央行借故重新加碼量寬只是時間問題,如此,就算經濟基本因素轉差,股市仍有條件繼續向好。

值得留意的是,近日金價雖然大跌,但美元匯價並非如大眾預期般急升,顯示金價與美元的相關性似乎暫時脫鈎。這是由於拋售黃金的投資者,不單沒有打算改持現金避險,反而趁機改持股票所致。

其實,市場資金正持續由黃金市場流向股市。據估計,今年淨流出黃金基金的資金合共 112 億美元,而同期淨流入股票基金的資金則達到 212.5 億美元。這反映了投資者的某種特殊心態:既然通脹一直未有出現,投資黃金以對抗通脹的作用開始減退,倒不如為手頭資金追逐較高回報。投資股票既可博取升值,又可賺取股息,成為了近期美股表現欲罷不能的一大支持因素。

只可惜,倘四大央行繼續如此粗暴地增加貨幣供應,相信通脹早晚會出現。部分投資者以為商品大跌令通脹威脅消失,其實只是錯覺!萬一有國家因而遇上滯脹,後果將更為嚴重。

不過,許多新興市場國家的央行,仍然對持有黃金充滿信心。其中,南非央行表示,無意改變儲備中黃金的比重;南韓央行更認為金價下跌其實沒甚麼大不了,黃金儲備是央行的長遠策略,不會輕易改變;至於斯里蘭卡央行更表示,目前是進一步吸納黃金儲備的大好機會。

央行雖然因為金價大跌令儲備價值萎縮,但某些央行官員反而因為商品價格大跌而感到無比欣慰,尤其是那些一直主張繼續無限 QE(量寬),但又不斷遭各方以通脹威脅逼近為由責難的央行官員。今回這群「超級鴿」終於可以吐氣揚眉了。

當市場開始相信全球暫無通脹威脅,主張繼續寬鬆政策的央行鴿派,自然有大條道理堅持不退市。本周四、五,華盛頓將一連兩日召開 G20 財長與央行行長會議,美、英、歐、日四大央行本來是眾矢之的,被指濫印銀紙,在全球製造資產泡沫與通脹。碰巧商品價格全線向下,大大紓緩了通脹壓力,已令有關指控化解於無形。

當市場的通脹預期回落,四大央行今後將更肆無忌憚加碼「放水」,無限 QE、QE 無限相信仍會繼續。美、英、歐、日央行借故重新加碼量寬只是時間問題,如此,就算經濟基本因素轉差,股市仍有條件繼續向好。

值得留意的是,近日金價雖然大跌,但美元匯價並非如大眾預期般急升,顯示金價與美元的相關性似乎暫時脫鈎。這是由於拋售黃金的投資者,不單沒有打算改持現金避險,反而趁機改持股票所致。

其實,市場資金正持續由黃金市場流向股市。據估計,今年淨流出黃金基金的資金合共 112 億美元,而同期淨流入股票基金的資金則達到 212.5 億美元。這反映了投資者的某種特殊心態:既然通脹一直未有出現,投資黃金以對抗通脹的作用開始減退,倒不如為手頭資金追逐較高回報。投資股票既可博取升值,又可賺取股息,成為了近期美股表現欲罷不能的一大支持因素。

只可惜,倘四大央行繼續如此粗暴地增加貨幣供應,相信通脹早晚會出現。部分投資者以為商品大跌令通脹威脅消失,其實只是錯覺!萬一有國家因而遇上滯脹,後果將更為嚴重。

散戶對機構

美國明尼阿波利斯聯儲主席昨日表示,美國經濟正處不穩定狀態,而當局正面臨兩難局面,加息可以降低金融危機風險,但收緊政策必將導致低就業和低物價,估計聯儲局在往後5至10年內,都要用極低利率去維持現時的金融市場狀況。

聯儲局可能會好長一段時間內都唔會加息,原本係利好大市消息,但EBay及UnitedHealth等財報令人失望,4月費城製造業指數為負0.1點,遠差過預期的3.3,最近一周的首次申領失業人數增幅多過預期。美股向下,杜指一度跌123點,尾市收復部份失地,收市跌81點,報14537點;標普500指數跌10點,收1542點。

黃金價格暴跌,全球投資者減持黃金ETF倉位,而印度、中國、香港等地散戶都出現「搶金潮」。據聞本地的金條金粒,被搶到斷晒市。有朋友亦問我係咪時候可以買?我認為從有短期需要(如結婚)的消費角度買金飾品,現時並無不可,但諗住「撈底」的心態去作中長線投資,將面臨較大風險。散戶流入市場買金,但黃金ETF今年已有112億美元淨流出,幫襯ETF較多機構投資者,機構沽、散戶買,呢個現象值得深思。

有分析指此次金價暴跌可能是大機構獲利后拋盤,導致市場跟風情緒所致,因為這次「金災」是在基本因素改變不大、但跌幅就比想像中大。可能係國外機構刻意推低金價,引起市場瘋狂拋售黃金,價位打壓到足夠低的時候,然後大量買進,即係所謂「殺完好友殺淡友」的投機行為。

不過,有時投機行為又會成為轉勢的借口。金價又實在太高,只要看美國為首的全球央行近期不斷印鈔票,但金價不漲反跌,可見黃金上衝1920美元高位後,已見頂回落。事實上,金價好友今仗被殺個血流成河,一些有經驗的投資者在這波降價潮中斬獲頗豐。

現在的情況係好友淡友正激撕殺。黃金目前正處於「高危期」,後向難料。廣東省黃金協會副會長朱志剛話「金價上演高台跳水,但誰都難以預計到底什麼價格才是底部。」筆者在此前亦提過,有美國專家用金價及通脹比率計算黃金的公平值係多少?結果係每安士800美元才是正常價格,相對現價的大約1350美元,仍有好大下跌空間,目前除了急跌後可能出現大反彈外,又睇唔到任何可以支撐金價整體掉頭向上的原因。高盛建議將避險投資由黃金轉入天然氣,也是看到黃金貴、天然氣平的價差。

美國的波士頓馬拉松比賽爆炸襲擊事件,這再次提醒大家,恐怖主義威脅依然存在。全球第二大經濟體中國經濟遲遲未見明顯復甦,今年季GDP增長更係不增反降。而不單係黃金,所有的大宗商品價格都在持續下跌,已經反映了環球經濟放緩這個「新常態」;而美國聯儲局不斷泵水入市場,但只谷起股市,經濟仍然在龜速前進,事實上,美股近期已出現高處不勝寒的現象。歐洲更係唔使多講,龍頭國家德國的評級日前才被「打柴」,真係唔爆新鑊已經飲得杯落。市場人氣隨時可能會急轉直下。

黃金已形成熊市形態,長線向下易過向上,市場只要有任何風吹草動,例如某財困國家要沽金套現救市,市場勢必上演人踩人現象,金價一瀉就係千里。對上一次金市爆煲係1980年代,金價最高每安士750美元,唔夠兩年就跌至300美元,足足跌了六成。黃金係經濟同政治景氣的寒暑表,現時的經濟環境及通脹情況,又未必好過得過以前喎。黃金唔掂,我亦唔睇好石油,88美元的油價一都唔平,相關股份開始要迴避。

商品市場的弱勢擴散到股市,美股標普500指數已從高位回落3.5%,有不少美股交易員擔心調整的勢頭終於開始,由於銅、鋁、鎳已是一年低位,相關商品股自然無運行,Freeport-McMoRan, Cliffs Natural Resources, Peabody Energy,美鋼全部在一年低位。除此之外,己有一堆相對弱的股份插完再插,蘋果跌穿400美元,低見393美元,也是一年低位(比去年9月高位705美元跌了44%),重機股Captepillar是去年7月以來低位,業績唔好的美銀今年股價也開始見紅。我怕是弱股先跌,慢慢擴散到強股去。

商品價格啟示錄

過去數週,商品價格大受打擊,但似乎低處未見低,事緣商品市場在過去十二年,一直沐浴於牛市之中,儘管需求上升不多,供應卻陸續有來。

工業股行運

然而,投資市場向來都是有人歡喜有人愁。對於商品供應商,尤其是那些缺乏生產彈性的,這無疑是個壞消息;不過,對於商品消費大國,如中國,則屬天賜恩物,幾乎等同減稅,企業因此得以減輕生產成本,提升毛利,刺激盈利和股價表現,「左右逢源」!

舉例說,依靠澳洲鐵礦「食胡」的中信泰富( 267)和中國鋁業( 2600)等資源類企業首當其衝,因為商品價格走下坡,被迫平賣產品。另邊廂,本倉很多成分股優先受惠,特別是工業股,如葉氏化工、德昌電機和偉易達。

外幣少玩為妙

商品市場兵敗如山倒後,下一個脆弱的資產類別自然是高息貨幣。商品貨幣,如澳元及加元匯價隨時會急速下跌,因外匯交易員和交易所買賣基金可能撤出投機性的套息交易活動!君不見日圓已經展開長期的跌浪,距離高位下挫了兩成半嗎?這場貨幣戰爭才剛剛開始,中國對日圓之表現自然感到不快,事關此舉令中國漸漸失去對日本的競爭優勢。

假如上述情況一如我所料般發生,依賴槓桿投資商品或貨幣的交易所買賣基金理論上會蝕得最「傷」,甚至「清袋」。所以,我的忠告是,只揸住有往績、有表現的投資工具。

記住,失之東隅,收之桑榆。商品價格崩塌,對於用家絕對是佳音。假如本倉成分股出現恐慌性拋售,務必趁機買入!很多時候,投資者眼見手上爛股插水,惶恐之下,一併把好股賣掉,我至今不明所以!《壹週刊》讀者好應利用這個市場的不理性,收集優質股。

工業股行運

然而,投資市場向來都是有人歡喜有人愁。對於商品供應商,尤其是那些缺乏生產彈性的,這無疑是個壞消息;不過,對於商品消費大國,如中國,則屬天賜恩物,幾乎等同減稅,企業因此得以減輕生產成本,提升毛利,刺激盈利和股價表現,「左右逢源」!

舉例說,依靠澳洲鐵礦「食胡」的中信泰富( 267)和中國鋁業( 2600)等資源類企業首當其衝,因為商品價格走下坡,被迫平賣產品。另邊廂,本倉很多成分股優先受惠,特別是工業股,如葉氏化工、德昌電機和偉易達。

外幣少玩為妙

商品市場兵敗如山倒後,下一個脆弱的資產類別自然是高息貨幣。商品貨幣,如澳元及加元匯價隨時會急速下跌,因外匯交易員和交易所買賣基金可能撤出投機性的套息交易活動!君不見日圓已經展開長期的跌浪,距離高位下挫了兩成半嗎?這場貨幣戰爭才剛剛開始,中國對日圓之表現自然感到不快,事關此舉令中國漸漸失去對日本的競爭優勢。

假如上述情況一如我所料般發生,依賴槓桿投資商品或貨幣的交易所買賣基金理論上會蝕得最「傷」,甚至「清袋」。所以,我的忠告是,只揸住有往績、有表現的投資工具。

記住,失之東隅,收之桑榆。商品價格崩塌,對於用家絕對是佳音。假如本倉成分股出現恐慌性拋售,務必趁機買入!很多時候,投資者眼見手上爛股插水,惶恐之下,一併把好股賣掉,我至今不明所以!《壹週刊》讀者好應利用這個市場的不理性,收集優質股。

Friday, April 19, 2013

鱼的营养与吃鱼的健康

吃鱼最主要的好处

到目前为止,吃鱼最主要的好处是针对心血管疾病。哈佛大学的研究发现,关于冠状动脉心脏病(冠心病)的死亡风险,每星期吃适量的富含脂肪酸的鱼的人比不吃的人低36%。

养殖的罗非鱼只含只有中等量的omega-3(ωs-3脂肪酸),相比之下使得它没有富含 omega-3的鱼类,如三纹鱼,金枪鱼,或鳟鱼那么更有利于心脏健康。

养殖的罗非鱼已被发现有高含量的omega-6脂肪酸,大概是因为鱼喂以玉米为主的饲料中omega-6的含量较高。omega-6是人体健康所必需的,但大多数人可以从其它食物来源获得足够的数量。一些科学家认为,太多饮食中omega-6S导致不健康的脂肪酸比例,他们认为这可以导致很多健康问题,包括心脏疾病。然而,也有些研究人员,怀疑这一假设。

对于心血管疾病和其他健康问题,吃鱼的大多数好处是由于鱼含有omega-3脂肪酸。omega-3脂肪酸是我们身体必需的营养素,但我们的身体不会非常有效产生这些脂肪酸。这种脂肪酸有好几种类型,但鱼和鱼油只提供两个,就是EPA和DHA,这两种脂肪酸已经被确认是对心脏健康有益的。这些健康的脂肪酸被添加到很多消费食品中,从鸡蛋到花生酱等等。

每周至少吃两餐鱼

美国心脏协会建议民众每周至少吃两餐鱼,尤其是富含脂肪的鱼,因为这样的鱼含有较高的

omega-3脂肪酸。每一餐的量是大约3.5盎司煮熟的鱼,或约3/4杯的鱼肉。这一数量非常接近美国农业部的每周8盎司或更多的鱼或贝类作为成人推荐标准,儿童相应减少。所谓的鱼,是指新鲜或盐水鱼。海鲜,包括鱼类和贝类。

贝类,包括螃蟹,龙虾,扇贝,海蚌等,一般来说脂肪含量相当低,而且脂肪的分布比许多其它蛋白质健康。虽然和大多数富含脂肪的鱼相比,贝类没有较高的omega-3脂肪酸,但是比牛肉和鸡肉含有较高比例的不饱和脂肪和低比例的饱和脂肪。贝类,包括甲壳类动物和软体动物,也是很好的蛋白质来源。

哪种鱼的omega-3脂肪酸比较高

三纹鱼是非常丰富的omega-3脂肪酸的来源,每4盎司三纹鱼的脂肪酸介于1,200和2,400毫克之间。其它高含量omega-3脂肪酸的鱼类,按每4盎司计,包括鲭鱼(1,350毫克至2100毫克),长鳍金枪鱼(1700毫克),鲱鱼(2,300-2,400毫克),凤尾鱼(2,300-2,400毫克),沙丁鱼(1,100-1,600毫克),淡水鳟鱼(1,000~1,100毫克)。

野生鱼类比养殖鱼类有更多的omega-3脂肪酸?

很多人认为野生鱼类比养殖鱼类有更多的omega-3脂肪酸,其实不一定。

这取决于鱼的种类。有些鱼,如三纹鱼,鲭鱼,鲱鱼,和鳟鱼,不论是野生还是养殖的,都含有较高的omega-3脂肪酸。但许多养殖鱼类,特别是罗非鱼也被推荐,因为它们被喂以玉米为主或其它高omega-6饮食,导致高omega-3脂肪酸的比例较高。其次,有一些养殖鱼类被更好的饮食喂养,尤其喂养时添加了鱼粉,鱼油,或藻类的,具有更优的omega-3脂肪酸对omega-6的比率。

据美国心脏协会的建议,民众最好从饮食中获得omega-3脂肪酸而非鱼油补充剂,因为前者是食用有机酸。不过,如果你是一个心脏疾病患者或如果由于某种原因,你不能从饮食中摄取到足够的omega-3脂肪酸,你可能要考虑使用鱼油补充剂。但是建议在使用前谘询您的医生。

吃鱼的利与弊

美国医学协会认为,吃鱼对健康的益处“大大超过”潜在的害处如汞,二恶英,多氯联苯,或其他污染物的污染。这类化学品水平如二恶英和多氯联苯,和肉类和奶制品相比在鱼内非常低。美国医学协会说,“目前尚不清楚,一般鱼类摄入的汞含量对非生育年龄男性和女性有什么不利的健康影响。”

鱼有时会有寄生虫,如果食用生鱼或轻保存的,如生鱼片或酸橘汁腌鱼,寄生虫就会成为一个问题。最常见的是线虫(也称为“鳕鱼蠕虫”或“鲱鱼蠕虫”)和绦虫。线虫,虽然很少发生,但人感染后,可导致一些消化问题,症状可持续一个星期左右。绦虫要糟糕得多:它们可以住在人体消化道很多年,最长的可以长到一米,引起剧烈的疼痛,体重减轻,贫血。

幸运的是,只要妥善把鱼煮熟,使其内部温度达到至少华氏140度就可杀死这些寄生虫。建议避免进食生鱼片,除非他们已经得到妥善的冰冻处理。

即使是最好的海产都要彻底煮熟,以避免食源性风险疾病。很多寿司和生鱼片级的鱼采用快速冻结的方式杀死寄生虫或来使用低风险寄生虫感染的鱼类。一般情况下,寿司级供应商是持有鱼寿司级的执照的。总之,吃生鱼的风险始终是大于吃煮熟的鱼。

如果你要吃生鱼片,美国农业部建议使用商业的鱼冻结标准:华氏零下10度 7天或者华氏零下31度 15小时。

孕妇或哺乳期妇女注意事项

美国农业部建议孕妇或哺乳期妇女应每周食用至少8到12盎司海鲜。美国农业部说:“中等量的证据显示,摄入omega-3脂肪酸特别是DHA,可以改善婴儿的健康,如视觉和认知能力的发展。”

然而,强烈建议孕妇避免含有高汞的鱼类,尤其是鲨鱼,箭鱼,方头鱼,鲭鱼。

美国农业部说,怀孕或哺乳妇女可以吃金枪鱼,但应限制摄入量,每周最多6盎司。

冷藏的熏制海产品(除非煮过的)具有增加细菌感染的风险,特别是李斯特菌病,所以呼吁孕妇,老年人,和免疫系统虚弱的人应尽量避免。这些食物通常标有“新星”,“液氧”,“熏”等标志。

为了减少污染物,如多氯联苯或二恶英的潜在风险,在烹调前可以去除鱼的皮肤和表面脂肪。然而,汞在鱼肉里是不能被去除的。

过敏与中毒

人们对海鲜过敏的现象是相当普遍的。过敏可以是非常具体的,比如您只是对一种鱼过敏,但吃其它海鲜没有任何问题;也可能是对很多的海鲜过敏,如各种类贝类或多种鱼。如果您对海鲜过敏,它很可能是终身的过敏,可能非常危险,甚至危及生命。

海鲜也可以是食物中毒的来源,特别是生吃时。偶尔也会发生由于海洋毒素引起的食物中毒。最常见的是鲭鱼或组胺鱼类中毒(如金枪鱼或鲭鱼的细菌)或“雪卡中毒”(如石斑鱼,真鲷和摄入的毒素的鲈鱼)。

怎样烹调鱼健康

美国心脏协会建议您避免吃油炸的鱼。油炸食品,尤其是用饱和或反式脂肪的烹调方式如油煎的鱼,与心脏疾病和中风有关。在一个对老年妇女的研究中显示,一个星期吃一餐煎鱼被发现比不吃煎鱼的人出现心脏衰竭的风险高出48%。烧烤或煮鱼的方法是比较健康的。

到目前为止,吃鱼最主要的好处是针对心血管疾病。哈佛大学的研究发现,关于冠状动脉心脏病(冠心病)的死亡风险,每星期吃适量的富含脂肪酸的鱼的人比不吃的人低36%。

养殖的罗非鱼只含只有中等量的omega-3(ωs-3脂肪酸),相比之下使得它没有富含 omega-3的鱼类,如三纹鱼,金枪鱼,或鳟鱼那么更有利于心脏健康。

养殖的罗非鱼已被发现有高含量的omega-6脂肪酸,大概是因为鱼喂以玉米为主的饲料中omega-6的含量较高。omega-6是人体健康所必需的,但大多数人可以从其它食物来源获得足够的数量。一些科学家认为,太多饮食中omega-6S导致不健康的脂肪酸比例,他们认为这可以导致很多健康问题,包括心脏疾病。然而,也有些研究人员,怀疑这一假设。

对于心血管疾病和其他健康问题,吃鱼的大多数好处是由于鱼含有omega-3脂肪酸。omega-3脂肪酸是我们身体必需的营养素,但我们的身体不会非常有效产生这些脂肪酸。这种脂肪酸有好几种类型,但鱼和鱼油只提供两个,就是EPA和DHA,这两种脂肪酸已经被确认是对心脏健康有益的。这些健康的脂肪酸被添加到很多消费食品中,从鸡蛋到花生酱等等。

每周至少吃两餐鱼

美国心脏协会建议民众每周至少吃两餐鱼,尤其是富含脂肪的鱼,因为这样的鱼含有较高的

omega-3脂肪酸。每一餐的量是大约3.5盎司煮熟的鱼,或约3/4杯的鱼肉。这一数量非常接近美国农业部的每周8盎司或更多的鱼或贝类作为成人推荐标准,儿童相应减少。所谓的鱼,是指新鲜或盐水鱼。海鲜,包括鱼类和贝类。

贝类,包括螃蟹,龙虾,扇贝,海蚌等,一般来说脂肪含量相当低,而且脂肪的分布比许多其它蛋白质健康。虽然和大多数富含脂肪的鱼相比,贝类没有较高的omega-3脂肪酸,但是比牛肉和鸡肉含有较高比例的不饱和脂肪和低比例的饱和脂肪。贝类,包括甲壳类动物和软体动物,也是很好的蛋白质来源。

哪种鱼的omega-3脂肪酸比较高

三纹鱼是非常丰富的omega-3脂肪酸的来源,每4盎司三纹鱼的脂肪酸介于1,200和2,400毫克之间。其它高含量omega-3脂肪酸的鱼类,按每4盎司计,包括鲭鱼(1,350毫克至2100毫克),长鳍金枪鱼(1700毫克),鲱鱼(2,300-2,400毫克),凤尾鱼(2,300-2,400毫克),沙丁鱼(1,100-1,600毫克),淡水鳟鱼(1,000~1,100毫克)。

野生鱼类比养殖鱼类有更多的omega-3脂肪酸?

很多人认为野生鱼类比养殖鱼类有更多的omega-3脂肪酸,其实不一定。

这取决于鱼的种类。有些鱼,如三纹鱼,鲭鱼,鲱鱼,和鳟鱼,不论是野生还是养殖的,都含有较高的omega-3脂肪酸。但许多养殖鱼类,特别是罗非鱼也被推荐,因为它们被喂以玉米为主或其它高omega-6饮食,导致高omega-3脂肪酸的比例较高。其次,有一些养殖鱼类被更好的饮食喂养,尤其喂养时添加了鱼粉,鱼油,或藻类的,具有更优的omega-3脂肪酸对omega-6的比率。

据美国心脏协会的建议,民众最好从饮食中获得omega-3脂肪酸而非鱼油补充剂,因为前者是食用有机酸。不过,如果你是一个心脏疾病患者或如果由于某种原因,你不能从饮食中摄取到足够的omega-3脂肪酸,你可能要考虑使用鱼油补充剂。但是建议在使用前谘询您的医生。

吃鱼的利与弊

美国医学协会认为,吃鱼对健康的益处“大大超过”潜在的害处如汞,二恶英,多氯联苯,或其他污染物的污染。这类化学品水平如二恶英和多氯联苯,和肉类和奶制品相比在鱼内非常低。美国医学协会说,“目前尚不清楚,一般鱼类摄入的汞含量对非生育年龄男性和女性有什么不利的健康影响。”

鱼有时会有寄生虫,如果食用生鱼或轻保存的,如生鱼片或酸橘汁腌鱼,寄生虫就会成为一个问题。最常见的是线虫(也称为“鳕鱼蠕虫”或“鲱鱼蠕虫”)和绦虫。线虫,虽然很少发生,但人感染后,可导致一些消化问题,症状可持续一个星期左右。绦虫要糟糕得多:它们可以住在人体消化道很多年,最长的可以长到一米,引起剧烈的疼痛,体重减轻,贫血。

幸运的是,只要妥善把鱼煮熟,使其内部温度达到至少华氏140度就可杀死这些寄生虫。建议避免进食生鱼片,除非他们已经得到妥善的冰冻处理。

即使是最好的海产都要彻底煮熟,以避免食源性风险疾病。很多寿司和生鱼片级的鱼采用快速冻结的方式杀死寄生虫或来使用低风险寄生虫感染的鱼类。一般情况下,寿司级供应商是持有鱼寿司级的执照的。总之,吃生鱼的风险始终是大于吃煮熟的鱼。

如果你要吃生鱼片,美国农业部建议使用商业的鱼冻结标准:华氏零下10度 7天或者华氏零下31度 15小时。

孕妇或哺乳期妇女注意事项

美国农业部建议孕妇或哺乳期妇女应每周食用至少8到12盎司海鲜。美国农业部说:“中等量的证据显示,摄入omega-3脂肪酸特别是DHA,可以改善婴儿的健康,如视觉和认知能力的发展。”

然而,强烈建议孕妇避免含有高汞的鱼类,尤其是鲨鱼,箭鱼,方头鱼,鲭鱼。

美国农业部说,怀孕或哺乳妇女可以吃金枪鱼,但应限制摄入量,每周最多6盎司。

冷藏的熏制海产品(除非煮过的)具有增加细菌感染的风险,特别是李斯特菌病,所以呼吁孕妇,老年人,和免疫系统虚弱的人应尽量避免。这些食物通常标有“新星”,“液氧”,“熏”等标志。

为了减少污染物,如多氯联苯或二恶英的潜在风险,在烹调前可以去除鱼的皮肤和表面脂肪。然而,汞在鱼肉里是不能被去除的。

过敏与中毒

人们对海鲜过敏的现象是相当普遍的。过敏可以是非常具体的,比如您只是对一种鱼过敏,但吃其它海鲜没有任何问题;也可能是对很多的海鲜过敏,如各种类贝类或多种鱼。如果您对海鲜过敏,它很可能是终身的过敏,可能非常危险,甚至危及生命。

海鲜也可以是食物中毒的来源,特别是生吃时。偶尔也会发生由于海洋毒素引起的食物中毒。最常见的是鲭鱼或组胺鱼类中毒(如金枪鱼或鲭鱼的细菌)或“雪卡中毒”(如石斑鱼,真鲷和摄入的毒素的鲈鱼)。

怎样烹调鱼健康

美国心脏协会建议您避免吃油炸的鱼。油炸食品,尤其是用饱和或反式脂肪的烹调方式如油煎的鱼,与心脏疾病和中风有关。在一个对老年妇女的研究中显示,一个星期吃一餐煎鱼被发现比不吃煎鱼的人出现心脏衰竭的风险高出48%。烧烤或煮鱼的方法是比较健康的。

研究:84%鱼类汞含量达危险水平 不能多

2013年01月16日讯

缅因州“生物多样性研究中心”(Biodiversity Research Institute,BRI)的调查发现,84%的鱼类汞含量超标。这对人类健康造成威胁,超过了某些鱼类每月不可食用超过一次的规定。

本周在日内瓦的联合国会议上,减少汞污染将是一个讨论议题,预计将完成一条美国支持的条约,以减少鱼类含汞的问题。

IMAX电影公司执行长理查德‧格尔丰德(Richard Gelfond)认为自己充满运动细胞,直到有一天,发生了非常严重的问题。他说:“我去作跑步时,感觉我即将摔倒,似乎我不能平衡。”

他谘询了美国东西两岸的知名医生,但是医生们找不出答案。他很担心,并说:“我已到了不能自已过马路的地步。我需要扶着我妻子的手。”

经过许多测试后,一个神经科医生问他是否吃了很多鱼。他回答说一天吃两次。诊断是他得了汞中毒。

格尔丰德说:“我以为我正在保护我的身体,原来我在吃对我身体有害的东西。”

吃鱼是得汞中毒的主要途径。金枪鱼(tuna)和剑鱼(swordfish)含汞量最高。汞能对大脑和肾脏造成永久性地损害。由于汞污染是全球性的,没有任何一个国家可以摆脱这种对粮食供应的污染。

国家资源保护委员会(NRDC)的成员格里尔(Linda Greer)说:“我们在美国吃的鱼,75%是进口的。”

她说:“许多我们所吃的鱼,都来自中国南海,这就是每天进入到我们的罐头和食物架的汞污染。”

拟议中的联合国条约要求:过滤燃烧煤排放出来的汞,禁止开采金矿时使用汞,减少在制造电子开关和电池时使用汞。

格尔丰德说:“我只能恢复到我过去体能的75%。例如,我仍然不能跑步,我永远都不能够做我以前能做的一些事情。”

本周在日内瓦的联合国会议上,减少汞污染将是一个讨论议题,预计将完成一条美国支持的条约,以减少鱼类含汞的问题。

IMAX电影公司执行长理查德‧格尔丰德(Richard Gelfond)认为自己充满运动细胞,直到有一天,发生了非常严重的问题。他说:“我去作跑步时,感觉我即将摔倒,似乎我不能平衡。”

他谘询了美国东西两岸的知名医生,但是医生们找不出答案。他很担心,并说:“我已到了不能自已过马路的地步。我需要扶着我妻子的手。”

经过许多测试后,一个神经科医生问他是否吃了很多鱼。他回答说一天吃两次。诊断是他得了汞中毒。

格尔丰德说:“我以为我正在保护我的身体,原来我在吃对我身体有害的东西。”

吃鱼是得汞中毒的主要途径。金枪鱼(tuna)和剑鱼(swordfish)含汞量最高。汞能对大脑和肾脏造成永久性地损害。由于汞污染是全球性的,没有任何一个国家可以摆脱这种对粮食供应的污染。

国家资源保护委员会(NRDC)的成员格里尔(Linda Greer)说:“我们在美国吃的鱼,75%是进口的。”

她说:“许多我们所吃的鱼,都来自中国南海,这就是每天进入到我们的罐头和食物架的汞污染。”

拟议中的联合国条约要求:过滤燃烧煤排放出来的汞,禁止开采金矿时使用汞,减少在制造电子开关和电池时使用汞。

格尔丰德说:“我只能恢复到我过去体能的75%。例如,我仍然不能跑步,我永远都不能够做我以前能做的一些事情。”

Sunday, April 14, 2013

唐志军:中国货币超发的恶果与潜因

中国货币超发的“盛况”

当前,货币超发是中国经济所面临的一个严重问题和热点话题。

货币超发是指货币发行增长速度超过货币需求的增长速度,即货币发行量超过了维持经济正常运行所需要的货币量。过去二十年,M2和M1都维持着18%左右的年均增速,远远超过10%左右的经济增长率。1990年,广义货币M2、狭义货币M1和流通中现金M0的余额分别为1.53万亿、6950亿和2644亿,到2012年将分别超过100万亿、32万亿和5.5万亿,短短20多年,分别增长了65倍、46倍和21倍。因此,有文章说中国已成为了世界上钱最多的国家。截至2012年10月末,中国广义货币M2余额为93.64万亿元。而同期的美国,其M2折合人民币则不超过60万亿元人民币,比中国少很多。就M2与GDP之比来说,中国恐怕是全球最高的国家之一,相比美国和日本而言,中国的M2/GDP将达到2.5,美国只有0.6到0.7,日本只有1。

中国货币超发的恶果

货币长时间里超发给中国经济和社会发展带来了诸多负面影响。

首先,货币超发会引发较严重通货膨胀。诺贝尔经济学奖获得者、货币主义大师弗里德曼认为,“通货膨胀无论在何时何地都是一种货币现象----通货膨胀的唯一原因是货币数量的增加。”因此,货币超发必然会带来通货膨胀。2003年-2011年,中国的通货膨胀率分别为1.2%、3.90%、1.8%、1.5%、4.80%、5.90%、-0.7%、3.3%、5.4%。平均值远高于美国同期。尤其是,2008-2009年,为缓解金融危机的影响,中国推出了大规模的信贷计划和宽松的货币政策,导致货币超发程度快速提高。结果就是2010年、2011年,中国陷入了通货膨胀漩涡。而且,考虑到中国的统计数据,中国的真实通货膨胀率要比公布的数据高的多!更重要的是,由于货币连年超发,多数经济学家预测未来中国很可能发生较严重的通货膨胀。

第二,会导致严重的资产泡沫。货币如流水,水多了,就会引起“流动性泛滥”,带来涝灾——即资产价格不断上涨的泡沫。当货币超发时,钱变得不再值钱,为保值增值,人们就会用剩余的钱来购买资产产品。超发的货币流到房地产市场引发房地产泡沫;超发的货币流到资产市场导致股市泡沫,投机盛行,把市场变赌场;流到艺术品投资市场引发天价的艺术品拍卖。于是,我们看到,中国的房地产和艺术品市场自2000年以后就进入到了一个疯狂上涨的阶段。房地产价格在10年间翻了5倍以上,而艺术品价格则翻倍更多。对中国股市而言,如果不是其制度和定位出现了根本性错误,中国股市也会像1980年代中末期的日本股市那样疯涨。

第三,会恶化收入分配、扩大贫富差距。货币超发会引起通货膨胀,而通货膨胀则是一种变相的税收,即所谓的通货膨胀税。因此,货币超发首先会将国民财富从国民手上转移到政府手里,使政府成为通货膨胀的最大赢家。由于货币超发,居民财富会由于通货膨胀而遭受严重的价值损失,33年里人民币贬值6倍多,1980年存100万到今天只值15万!另外,国有企业、地方政府和富人也是货币超发的受益者,而穷人则成为货币超发的受伤害者。在我国的体制条件下,国有企业与私营企业享受完全不同的国民待遇,最先也容易得到贷款的是国有企业。货币发行越多,国有企业得到的贷款就越多,他们就越有钱用于自身发展或用于挥霍腐败。地方政府呢?也是宽松货币政策的受益者。在我国的政治和财税体制下,地方政府具有发展GDP的强烈愿望。货币发行越多,地方政府得到信贷就越容易,就越有钱用于扩大投资,搞政绩工程和项目建设,并顺便享受经济发展和项目建设所带来的各种好处(如大肆收受贿赂)。对于富人而言,他们具有多种投资渠道和方式,由货币超发所带来的资产价格上涨的收益会超过通货膨胀所带来的损失。然而,对穷人和固定工资者而言,货币超发就如个吸血虫,会把他们在银行里的存款和工资慢慢的吸食掉。

第四,会挫伤社会各阶层的劳动积极性、创造性。在货币超发的情况下投机盛行,受资产泡沫化的影响,股市和房地产市场的资金回报率远远超过商品市场的回报率。这导致超发的货币很容易流向股市、房市和期市。当人们看到炒股、炒房会很快发家致富时,谁还有心思去经营实业、去努力工作呢?于是,企业家不愿做实业,工人不愿意按部就班地上班、学生不安心上学,科学家不安心搞科研,人人都想去挣快钱,梦想一夜暴富。

第五,会损害政府信用。现代政府的一项基本的经济职能就是保持币值稳定,避免货币的购买力受损。如果不能保持货币的稳定性,社会信用体系就会遭到破坏,政府、企业和个人行为就会受到扭曲,最终伤害的是政府的信誉。货币超发除了让老百姓被动地缴纳铸币税之外,还拉大贫富差距,使穷人过得更加辛酸,使他们有被剥夺和上当受骗的感觉,从而严重影响他们对政府的信心和社会的稳定。

按照经济的普遍规律,如此大的货币超发,在一个已经市场化的国家必然会引起恶性通货膨胀。然而庆幸的是,中国处于一个从计划经济向市场经济过渡的时期,商品货币化、住宅货币化以及股票市场、债券市场的发育,加之中国人不得不储蓄等承担了蓄水池的作用,将可能带来“流动性泛滥”的洪灾拦截了很大一部分,避免了中国出现严重通货膨胀。

中国货币超发的真实原因

既然货币超发会带来这么多的负面效应,为什么中国的货币还会在长时间里保持超发状态呢?难道中国的决策者们不知道货币超发所可能引起的严重后果吗?

有的学者认为是中国经济货币化和金融化造成的。在从计划经济转轨到市场经济中,大部门商品需要货币化,此过程会需要大量的远远超出GDP总量货币。而1998年房改启动,则开启了中国资产货币化的进程,同时启动了土地的货币化进程。例如住房市场开放后,需要大量货币;中国债市,主要是金融债有近30万亿,中国股市也需要大量资金,股市市值与GDP差不多。而美国经济很早就货币化了。

有人认为是中国汇率制度惹的祸。中国是一个外汇管制国家,按规定企业在外管局核定的外汇保留额度之上的外汇必须卖给国家,企业需要用汇必须向国家购买。比如说,如果美元兑人民币的汇价是1:8,此时,中国的外汇储备每多一美元,就迫使央行释放出8元人民币的基础货币(即M0)。如果中国一年的外汇储备增加2000亿美元,就会迫使央行被迫发行1.6万亿的巨额基础货币,经过货币乘数的放大作用,这1.6万亿基础货币将放大为5万亿以上(即M2增加5万亿以上)。即便央行采取一些反向操作,回笼一部分基础货币,但也无力回笼如此巨大的数量。

有人认为是金融改革的副产品。为了改革金融系统,央行实际投放了大量的基础货币。2003年,中央汇金公司正式向中国银行[0.34% 资金 研报]和建设银行[0.21% 资金 研报]各注资225亿美元,拉开了新一轮银行改革。这两家银行拿了450亿美元以后转手向国家结汇,等于人民银行又把450亿美元拿回来了,这就是相当于直接投放了450*8=3600亿人民币的基础货币。此外,为了处理这两家银行的不良资产(次级和损失类贷款),四大资产管理公司从两家银行购买了本金大约1289亿(建设银行)+1500亿(中国银行)=2789亿不良资产,央行按照贷款本金50%发行专项票据约1400亿协助银行处理不良资产,这实际上也是货币投放。其实这还没有完,央行发行票据210亿元偿付建设银行因托管一家信托投资公司产生的代垫款项,央行发行181亿票据置换中国银行的一些特殊资产。这样央行为了帮助这两家银行共支付了5391亿,相当于间接投放了这么多货币。而后来的工商银行[-0.25% 资金 研报]、农业银行[0.37% 资金 研报]、城市商业银行和农村信用社的改革同样遵循此逻辑展开,又释放高达15000亿元左右的基础货币。也就是说,为了国家的金融改革,央行实际上大概发行了约2万亿的基础货币。

然而,在我看来,以上解释还存在待商榷之处,引发中国出现货币超发的真正原因还在于权力失衡。

第一,货币的发行权掌握在中央决策层和央行手中,央行是货币的供给方。在由计划经济向市场经济转轨进程中,商品和资产的货币化只是产生对货币的需求,是作为需求的一方而存在的。基本货币化会对央行产生一种需求压力,在某种程度上使央行释放出货币。然而,其一,是否真正发行货币、发行多少货币却是由央行决定的,也就是说,央行才是货币超发的最终决定者。其二,商品和资产的货币化,恰恰犹如一个蓄水池,会吸容大量由央行释放出来的货币洪水;如果没有这个蓄水池,中国的通货膨胀率就会高到天上去!其实,就中国的货币政策而言,在以“发展是硬道理”、“增长中心主义”为执政第一要务之下,决策者一直是以货币政策作为推动经济增长的一个重要引擎。为推动经济增长,使GDP维持在一个较高的增长水平,决策者只好通过宽松的货币政策来刺激投资和支付改革的巨大成本。而权力失衡,则赋予了决策者控制货币政策的权力和自由。

第二,对于中国的外汇占款来说,为什么中国会形成如此大的外汇储备、并导致巨额的货币被动超发呢?其原因也在于权力失衡。首先,正如我在《为什么中国的外汇储备如此之多》一文中所指出的那样,从国民收入恒等式中可以看出,一国外汇储备是否增加取决于其产出与内需之间的差额,如果产出大于需求,就会导致出口和外汇流入。而需求则取决于一国的收入分配状况,收入分配失衡就会导致经济失衡,进而影响到对外贸易和投资的均衡。而收入分配由取决于权力结构,如果权力结构失衡,则收入分配必然失衡。其次,外汇占款还与中国的汇率制度息息相关。长期以来,中国都坚守固定汇率制度、搞外汇管制,强制居民将外汇兑给央行。那么,为什么能推行这样的制度呢?这显然也与权力失衡息息相关。在中国,由于权力失衡,一项制度的生成基本上是由最高领导层决定的,民众鲜有参与制度制定的机会,也基本上没有能力去影响制度的生成。也就是说,搞外汇管制和推行外汇结算制度,都是权力失衡的产物。

第三,金融改革为什么要国家来买单呢?为什么民营企业的改革和发展国家却可以置之身外、不用为其买单呢?这也是由中国的权力结构所决定的。计划经济时期,中国除了一个中央银行外,几乎没有其他的金融机构。1980年代开始设立各种经营性银行。然而,由于权力失衡,一则是这些银行主要是国有银行,二则这些银行主要以服务于国有企业和各级政府为主。正是因为国有企业的大面积亏损和国有银行不得不承担的政策性贷款,加之国有银行本身的经营不善,使其背负了巨额的负债。如此巨额的负债从某种程度上挟持了中国经济,一旦国有银行发生支付危机,中国经济之船就会在风雨中飘摇动荡。为此,国家不得不为国有银行支付巨额的改革成本,从而释放出巨额的基础货币。而民营企业呢?一则是其规模较小,其倒闭破产也不会引起系统性风险;二是由于其分散性,民营企业主在政治上,不像国有企业尤其是银行那样具有很大的话语权。因此,民营企业常常成为各级政府和国企忽视、限制,甚至是打压的对象(从1980年代开始,民营企业就曾遭受过许多不公正的对待,直到今天,还有各种壁垒限制其进入和发展)。

第四,中国货币超发的另一个重要原因是来自地方政府和国有企业的倒逼效应。可以说,我国货币供给“倒逼机制”的产生源头在国有企业与地方政府的勾结中。在我国,由于政治上的晋升制度和财政上的分税制度,迫使地方政府不得不为做大GDP而努力。而且,由于改革的不到位,国有企业的预算约束软化状况同传统计划体制下相比并没有得到根本改观,因此,它们总是和地方政府的行政力量相融合,在货币资金获取上向国有银行不断施加压力。国有银行在存在对国有企业实行所谓倾斜政策的大背景下,通常总是要在一定程度对国有企业的借款要求让步。当这种现象普遍化时,就会出现这样的结果:地方政府向属地国有企业施压,要求其更快发展和承担政策性任务;国有企业向国有银行的基层行施加压力,突破了基层银行的信贷配额防线,国有银行的基层行又层层向自己的上级行乃至总行提出扩张要求迫使总行增加额度甚至资金,各国有银行总行最后又向中央银行申请再贷款,迫使中央银行不得不扩张规模。这种起源于国有企业借款要求的自下而上的货币供给扩张过程,就是所谓的“倒逼机制”。而倒逼效应之所以会出现,也与地方政府和国有企业独特的政治地位和权力紧密相连。如果没有权力结构的支撑,这种“倒逼机制”是无法形成的。试问,民营企业能产生货币供给的“倒逼效应”吗?

由此,我们看出,央行缺乏独立性、外汇管制和对外经济失衡、国有金融机构、国有企业和地方政府“倒逼机制”的生成都会导致中国货币超发,而这些因素都是中国权力失衡的产物!因此,要解决中国的货币超发问题,最根本的还在于解决中国的权力失衡问题。

唐志军为经济学博士,湖南科技大学经济学教师

当前,货币超发是中国经济所面临的一个严重问题和热点话题。

货币超发是指货币发行增长速度超过货币需求的增长速度,即货币发行量超过了维持经济正常运行所需要的货币量。过去二十年,M2和M1都维持着18%左右的年均增速,远远超过10%左右的经济增长率。1990年,广义货币M2、狭义货币M1和流通中现金M0的余额分别为1.53万亿、6950亿和2644亿,到2012年将分别超过100万亿、32万亿和5.5万亿,短短20多年,分别增长了65倍、46倍和21倍。因此,有文章说中国已成为了世界上钱最多的国家。截至2012年10月末,中国广义货币M2余额为93.64万亿元。而同期的美国,其M2折合人民币则不超过60万亿元人民币,比中国少很多。就M2与GDP之比来说,中国恐怕是全球最高的国家之一,相比美国和日本而言,中国的M2/GDP将达到2.5,美国只有0.6到0.7,日本只有1。

中国货币超发的恶果

货币长时间里超发给中国经济和社会发展带来了诸多负面影响。

首先,货币超发会引发较严重通货膨胀。诺贝尔经济学奖获得者、货币主义大师弗里德曼认为,“通货膨胀无论在何时何地都是一种货币现象----通货膨胀的唯一原因是货币数量的增加。”因此,货币超发必然会带来通货膨胀。2003年-2011年,中国的通货膨胀率分别为1.2%、3.90%、1.8%、1.5%、4.80%、5.90%、-0.7%、3.3%、5.4%。平均值远高于美国同期。尤其是,2008-2009年,为缓解金融危机的影响,中国推出了大规模的信贷计划和宽松的货币政策,导致货币超发程度快速提高。结果就是2010年、2011年,中国陷入了通货膨胀漩涡。而且,考虑到中国的统计数据,中国的真实通货膨胀率要比公布的数据高的多!更重要的是,由于货币连年超发,多数经济学家预测未来中国很可能发生较严重的通货膨胀。

第二,会导致严重的资产泡沫。货币如流水,水多了,就会引起“流动性泛滥”,带来涝灾——即资产价格不断上涨的泡沫。当货币超发时,钱变得不再值钱,为保值增值,人们就会用剩余的钱来购买资产产品。超发的货币流到房地产市场引发房地产泡沫;超发的货币流到资产市场导致股市泡沫,投机盛行,把市场变赌场;流到艺术品投资市场引发天价的艺术品拍卖。于是,我们看到,中国的房地产和艺术品市场自2000年以后就进入到了一个疯狂上涨的阶段。房地产价格在10年间翻了5倍以上,而艺术品价格则翻倍更多。对中国股市而言,如果不是其制度和定位出现了根本性错误,中国股市也会像1980年代中末期的日本股市那样疯涨。

第三,会恶化收入分配、扩大贫富差距。货币超发会引起通货膨胀,而通货膨胀则是一种变相的税收,即所谓的通货膨胀税。因此,货币超发首先会将国民财富从国民手上转移到政府手里,使政府成为通货膨胀的最大赢家。由于货币超发,居民财富会由于通货膨胀而遭受严重的价值损失,33年里人民币贬值6倍多,1980年存100万到今天只值15万!另外,国有企业、地方政府和富人也是货币超发的受益者,而穷人则成为货币超发的受伤害者。在我国的体制条件下,国有企业与私营企业享受完全不同的国民待遇,最先也容易得到贷款的是国有企业。货币发行越多,国有企业得到的贷款就越多,他们就越有钱用于自身发展或用于挥霍腐败。地方政府呢?也是宽松货币政策的受益者。在我国的政治和财税体制下,地方政府具有发展GDP的强烈愿望。货币发行越多,地方政府得到信贷就越容易,就越有钱用于扩大投资,搞政绩工程和项目建设,并顺便享受经济发展和项目建设所带来的各种好处(如大肆收受贿赂)。对于富人而言,他们具有多种投资渠道和方式,由货币超发所带来的资产价格上涨的收益会超过通货膨胀所带来的损失。然而,对穷人和固定工资者而言,货币超发就如个吸血虫,会把他们在银行里的存款和工资慢慢的吸食掉。

第四,会挫伤社会各阶层的劳动积极性、创造性。在货币超发的情况下投机盛行,受资产泡沫化的影响,股市和房地产市场的资金回报率远远超过商品市场的回报率。这导致超发的货币很容易流向股市、房市和期市。当人们看到炒股、炒房会很快发家致富时,谁还有心思去经营实业、去努力工作呢?于是,企业家不愿做实业,工人不愿意按部就班地上班、学生不安心上学,科学家不安心搞科研,人人都想去挣快钱,梦想一夜暴富。

第五,会损害政府信用。现代政府的一项基本的经济职能就是保持币值稳定,避免货币的购买力受损。如果不能保持货币的稳定性,社会信用体系就会遭到破坏,政府、企业和个人行为就会受到扭曲,最终伤害的是政府的信誉。货币超发除了让老百姓被动地缴纳铸币税之外,还拉大贫富差距,使穷人过得更加辛酸,使他们有被剥夺和上当受骗的感觉,从而严重影响他们对政府的信心和社会的稳定。

按照经济的普遍规律,如此大的货币超发,在一个已经市场化的国家必然会引起恶性通货膨胀。然而庆幸的是,中国处于一个从计划经济向市场经济过渡的时期,商品货币化、住宅货币化以及股票市场、债券市场的发育,加之中国人不得不储蓄等承担了蓄水池的作用,将可能带来“流动性泛滥”的洪灾拦截了很大一部分,避免了中国出现严重通货膨胀。

中国货币超发的真实原因

既然货币超发会带来这么多的负面效应,为什么中国的货币还会在长时间里保持超发状态呢?难道中国的决策者们不知道货币超发所可能引起的严重后果吗?

有的学者认为是中国经济货币化和金融化造成的。在从计划经济转轨到市场经济中,大部门商品需要货币化,此过程会需要大量的远远超出GDP总量货币。而1998年房改启动,则开启了中国资产货币化的进程,同时启动了土地的货币化进程。例如住房市场开放后,需要大量货币;中国债市,主要是金融债有近30万亿,中国股市也需要大量资金,股市市值与GDP差不多。而美国经济很早就货币化了。

有人认为是中国汇率制度惹的祸。中国是一个外汇管制国家,按规定企业在外管局核定的外汇保留额度之上的外汇必须卖给国家,企业需要用汇必须向国家购买。比如说,如果美元兑人民币的汇价是1:8,此时,中国的外汇储备每多一美元,就迫使央行释放出8元人民币的基础货币(即M0)。如果中国一年的外汇储备增加2000亿美元,就会迫使央行被迫发行1.6万亿的巨额基础货币,经过货币乘数的放大作用,这1.6万亿基础货币将放大为5万亿以上(即M2增加5万亿以上)。即便央行采取一些反向操作,回笼一部分基础货币,但也无力回笼如此巨大的数量。

有人认为是金融改革的副产品。为了改革金融系统,央行实际投放了大量的基础货币。2003年,中央汇金公司正式向中国银行[0.34% 资金 研报]和建设银行[0.21% 资金 研报]各注资225亿美元,拉开了新一轮银行改革。这两家银行拿了450亿美元以后转手向国家结汇,等于人民银行又把450亿美元拿回来了,这就是相当于直接投放了450*8=3600亿人民币的基础货币。此外,为了处理这两家银行的不良资产(次级和损失类贷款),四大资产管理公司从两家银行购买了本金大约1289亿(建设银行)+1500亿(中国银行)=2789亿不良资产,央行按照贷款本金50%发行专项票据约1400亿协助银行处理不良资产,这实际上也是货币投放。其实这还没有完,央行发行票据210亿元偿付建设银行因托管一家信托投资公司产生的代垫款项,央行发行181亿票据置换中国银行的一些特殊资产。这样央行为了帮助这两家银行共支付了5391亿,相当于间接投放了这么多货币。而后来的工商银行[-0.25% 资金 研报]、农业银行[0.37% 资金 研报]、城市商业银行和农村信用社的改革同样遵循此逻辑展开,又释放高达15000亿元左右的基础货币。也就是说,为了国家的金融改革,央行实际上大概发行了约2万亿的基础货币。

然而,在我看来,以上解释还存在待商榷之处,引发中国出现货币超发的真正原因还在于权力失衡。

第一,货币的发行权掌握在中央决策层和央行手中,央行是货币的供给方。在由计划经济向市场经济转轨进程中,商品和资产的货币化只是产生对货币的需求,是作为需求的一方而存在的。基本货币化会对央行产生一种需求压力,在某种程度上使央行释放出货币。然而,其一,是否真正发行货币、发行多少货币却是由央行决定的,也就是说,央行才是货币超发的最终决定者。其二,商品和资产的货币化,恰恰犹如一个蓄水池,会吸容大量由央行释放出来的货币洪水;如果没有这个蓄水池,中国的通货膨胀率就会高到天上去!其实,就中国的货币政策而言,在以“发展是硬道理”、“增长中心主义”为执政第一要务之下,决策者一直是以货币政策作为推动经济增长的一个重要引擎。为推动经济增长,使GDP维持在一个较高的增长水平,决策者只好通过宽松的货币政策来刺激投资和支付改革的巨大成本。而权力失衡,则赋予了决策者控制货币政策的权力和自由。

第二,对于中国的外汇占款来说,为什么中国会形成如此大的外汇储备、并导致巨额的货币被动超发呢?其原因也在于权力失衡。首先,正如我在《为什么中国的外汇储备如此之多》一文中所指出的那样,从国民收入恒等式中可以看出,一国外汇储备是否增加取决于其产出与内需之间的差额,如果产出大于需求,就会导致出口和外汇流入。而需求则取决于一国的收入分配状况,收入分配失衡就会导致经济失衡,进而影响到对外贸易和投资的均衡。而收入分配由取决于权力结构,如果权力结构失衡,则收入分配必然失衡。其次,外汇占款还与中国的汇率制度息息相关。长期以来,中国都坚守固定汇率制度、搞外汇管制,强制居民将外汇兑给央行。那么,为什么能推行这样的制度呢?这显然也与权力失衡息息相关。在中国,由于权力失衡,一项制度的生成基本上是由最高领导层决定的,民众鲜有参与制度制定的机会,也基本上没有能力去影响制度的生成。也就是说,搞外汇管制和推行外汇结算制度,都是权力失衡的产物。

第三,金融改革为什么要国家来买单呢?为什么民营企业的改革和发展国家却可以置之身外、不用为其买单呢?这也是由中国的权力结构所决定的。计划经济时期,中国除了一个中央银行外,几乎没有其他的金融机构。1980年代开始设立各种经营性银行。然而,由于权力失衡,一则是这些银行主要是国有银行,二则这些银行主要以服务于国有企业和各级政府为主。正是因为国有企业的大面积亏损和国有银行不得不承担的政策性贷款,加之国有银行本身的经营不善,使其背负了巨额的负债。如此巨额的负债从某种程度上挟持了中国经济,一旦国有银行发生支付危机,中国经济之船就会在风雨中飘摇动荡。为此,国家不得不为国有银行支付巨额的改革成本,从而释放出巨额的基础货币。而民营企业呢?一则是其规模较小,其倒闭破产也不会引起系统性风险;二是由于其分散性,民营企业主在政治上,不像国有企业尤其是银行那样具有很大的话语权。因此,民营企业常常成为各级政府和国企忽视、限制,甚至是打压的对象(从1980年代开始,民营企业就曾遭受过许多不公正的对待,直到今天,还有各种壁垒限制其进入和发展)。

第四,中国货币超发的另一个重要原因是来自地方政府和国有企业的倒逼效应。可以说,我国货币供给“倒逼机制”的产生源头在国有企业与地方政府的勾结中。在我国,由于政治上的晋升制度和财政上的分税制度,迫使地方政府不得不为做大GDP而努力。而且,由于改革的不到位,国有企业的预算约束软化状况同传统计划体制下相比并没有得到根本改观,因此,它们总是和地方政府的行政力量相融合,在货币资金获取上向国有银行不断施加压力。国有银行在存在对国有企业实行所谓倾斜政策的大背景下,通常总是要在一定程度对国有企业的借款要求让步。当这种现象普遍化时,就会出现这样的结果:地方政府向属地国有企业施压,要求其更快发展和承担政策性任务;国有企业向国有银行的基层行施加压力,突破了基层银行的信贷配额防线,国有银行的基层行又层层向自己的上级行乃至总行提出扩张要求迫使总行增加额度甚至资金,各国有银行总行最后又向中央银行申请再贷款,迫使中央银行不得不扩张规模。这种起源于国有企业借款要求的自下而上的货币供给扩张过程,就是所谓的“倒逼机制”。而倒逼效应之所以会出现,也与地方政府和国有企业独特的政治地位和权力紧密相连。如果没有权力结构的支撑,这种“倒逼机制”是无法形成的。试问,民营企业能产生货币供给的“倒逼效应”吗?

由此,我们看出,央行缺乏独立性、外汇管制和对外经济失衡、国有金融机构、国有企业和地方政府“倒逼机制”的生成都会导致中国货币超发,而这些因素都是中国权力失衡的产物!因此,要解决中国的货币超发问题,最根本的还在于解决中国的权力失衡问题。

唐志军为经济学博士,湖南科技大学经济学教师

中国被指全球最大印钞机 去年新增货币占全球近一半

2009年以来,中国央行的货币供应量先后超过日本、美国、欧元区,成为目前全球最大的“印钞机”。2012年,全球新增货币供应量超26万亿元人民币,中国占近一半。21世纪网评估发现,均衡人均收入差异后,中国的经济货币化程度高居全球前列。

数读财经:中国货币超发严重经济货币化领先全球

5年前的次贷危机之后,全球主要经济体的印钞机一直马达轰鸣。流动性泛滥的洪水,不知何时会淹没世界。

2013年1月22日,日本央行推出超量化宽松政策,包括无限制资产购买及上调通胀目标至2%。而美国马不停蹄连推QE(量化宽松政策),欧洲央行有无限制购债计划,新一轮货币战争又如箭在弦。

中国去年新增货币供应占全球近半

考察一国的印钞额,国际上一般采用M2指标来度量。M2是指“广义货币”,是货币供应量的重要指标之一,国际上M2的计算公式是 “流通中的现金+支票存款+储蓄存款+政府债券”。M2不仅反映现实的购买力(现金+支票存款),还反映潜在的购买力(储蓄存款+政府债券).

21世纪网数据部统计来自全球主要央行的2008-2012年M2数据得出,截至2012年末,全球货币供应量余额已超过人民币366万亿元。其中,超过100万亿元人民币即27%左右,是在金融危机爆发的2008年后5年时间里新增的货币供应量。期间,每年全球新增的货币量逐渐扩大,2012年这一值达到最高峰,合计人民币26.25万亿元,足以抵上5个俄罗斯截止2012年末的货币供应量。

全球货币的泛滥,已到了十分严重的地步。而在这股货币超发洪流中,中国也已成长为流动性“巨人”。

从存量上看,中国货币量已领先全球。根据中国央行数据,截至2012年末,中国M2余额达到人民币97.42万亿元,居世界第一,接近全球货币供应总量的四分之一,是美国的1.5倍,比整个欧元区的货币供应量(约75.25万亿元人民币)多出不只一个英国全年的供应量(2012年为19.97万亿元人民币).

回顾2010年,中国的M2余额才刚与欧元区旗鼓相当;2008年,中国的M2余额更是排不上全球前三,落后日本、美国,可见中国货币存量增长之快。

从增量上看,中国的新增货币供应量也让美国、日本、欧元区、英国望尘莫及

从增量上看,中国的新增货币供应量也让美国、日本、欧元区、英国望尘莫及

根据21世纪网数据部的统计,2008年中国、美国、欧元区新增的货币供应量分别折合为人民币7.17万亿元、5.08万亿元、5.70万亿元,基本在一个水平线上浮动。

2009年,美、日、英、欧同时大幅减少新增M2,但中国的新增货币供应量却一下子蹿到13.51万亿元人民币。随后每年中国M2增量均保持在12万亿左右的水平。只用了4年,中国货币供应量就激增50万亿元,存量翻番。

全球范围来看,在新增的货币供应量上,中国已连续4年贡献约一半。根据渣打银行2012年的报告,金融危机爆发以后的2009-2011年间,全球新增的M2中,人民币贡献了48%;在2011年贡献率更是达到52%。这样的增长规模和态势在世界各国经济发展史上都是少有的。

2012年,中国继续“巨量印钞”,新增M2达12.26万亿元,在全球新增M2中占比仍高达46.7%。

值得注意的是,尽管全球2012年新增货币量再度创新高,但事实上,多数国家在新增货币供应量上比2011年有所控制。21世纪网数据部统计,美国2011年新增8713亿美元M2,2012年新增M2下滑12.17%至7653亿美元;日本2011年新增25.3万亿日元M2,2012年新增21.6万亿日元M2,下滑速度达 16.19%,更甚于美国。

值得注意的是,尽管全球2012年新增货币量再度创新高,但事实上,多数国家在新增货币供应量上比2011年有所控制。21世纪网数据部统计,美国2011年新增8713亿美元M2,2012年新增M2下滑12.17%至7653亿美元;日本2011年新增25.3万亿日元M2,2012年新增21.6万亿日元M2,下滑速度达 16.19%,更甚于美国。

2012年全球新增货币供应量之所以高出2011年,主要源于欧元区2012年新增货币供应量扩大2174亿欧元,约1.82万亿元人民币。欧元区比全球任何一个国家都急需释放流动性来刺激经济复苏。

作为全球最大的“印钞机”,中国虽然对货币供应量也有所控制,但无论从绝对水平还是相对水平来看,都未太放松马力。

数读财经:中国货币超发严重经济货币化领先全球

5年前的次贷危机之后,全球主要经济体的印钞机一直马达轰鸣。流动性泛滥的洪水,不知何时会淹没世界。

2013年1月22日,日本央行推出超量化宽松政策,包括无限制资产购买及上调通胀目标至2%。而美国马不停蹄连推QE(量化宽松政策),欧洲央行有无限制购债计划,新一轮货币战争又如箭在弦。

中国去年新增货币供应占全球近半

考察一国的印钞额,国际上一般采用M2指标来度量。M2是指“广义货币”,是货币供应量的重要指标之一,国际上M2的计算公式是 “流通中的现金+支票存款+储蓄存款+政府债券”。M2不仅反映现实的购买力(现金+支票存款),还反映潜在的购买力(储蓄存款+政府债券).

21世纪网数据部统计来自全球主要央行的2008-2012年M2数据得出,截至2012年末,全球货币供应量余额已超过人民币366万亿元。其中,超过100万亿元人民币即27%左右,是在金融危机爆发的2008年后5年时间里新增的货币供应量。期间,每年全球新增的货币量逐渐扩大,2012年这一值达到最高峰,合计人民币26.25万亿元,足以抵上5个俄罗斯截止2012年末的货币供应量。

全球货币的泛滥,已到了十分严重的地步。而在这股货币超发洪流中,中国也已成长为流动性“巨人”。

从存量上看,中国货币量已领先全球。根据中国央行数据,截至2012年末,中国M2余额达到人民币97.42万亿元,居世界第一,接近全球货币供应总量的四分之一,是美国的1.5倍,比整个欧元区的货币供应量(约75.25万亿元人民币)多出不只一个英国全年的供应量(2012年为19.97万亿元人民币).

回顾2010年,中国的M2余额才刚与欧元区旗鼓相当;2008年,中国的M2余额更是排不上全球前三,落后日本、美国,可见中国货币存量增长之快。

根据21世纪网数据部的统计,2008年中国、美国、欧元区新增的货币供应量分别折合为人民币7.17万亿元、5.08万亿元、5.70万亿元,基本在一个水平线上浮动。

2009年,美、日、英、欧同时大幅减少新增M2,但中国的新增货币供应量却一下子蹿到13.51万亿元人民币。随后每年中国M2增量均保持在12万亿左右的水平。只用了4年,中国货币供应量就激增50万亿元,存量翻番。

全球范围来看,在新增的货币供应量上,中国已连续4年贡献约一半。根据渣打银行2012年的报告,金融危机爆发以后的2009-2011年间,全球新增的M2中,人民币贡献了48%;在2011年贡献率更是达到52%。这样的增长规模和态势在世界各国经济发展史上都是少有的。

2012年,中国继续“巨量印钞”,新增M2达12.26万亿元,在全球新增M2中占比仍高达46.7%。

2012年全球新增货币供应量之所以高出2011年,主要源于欧元区2012年新增货币供应量扩大2174亿欧元,约1.82万亿元人民币。欧元区比全球任何一个国家都急需释放流动性来刺激经济复苏。

作为全球最大的“印钞机”,中国虽然对货币供应量也有所控制,但无论从绝对水平还是相对水平来看,都未太放松马力。

中国M2/GDP创新高:危险信号

“M2/GDP”通常被用来度量一国的货币超发程度,一般而言,该比值越大,货币超发越严重。M2和GDP数据的单位都是当年本地货币,对中国来说即当年人民币的名义值,两者相除的比率则冲销了通胀影响。

随着2012年12月M2余额逼近百万亿大关,全年GDP达到51.93万亿,中国M2与GDP的比例再度创下历史新高——1.88倍。加之12月CPI出现超预期反弹,关于“中国货币严重超发”的质疑之声再次甚嚣尘上。

也有券商分析师以“M2总量超过GDP已是全球普遍现象,且M2/GDP排名靠前的多数是世界人均收入水平较高的国家”为由,认为中国不存在严重的货币超发现象。

从世界银行提供的截至2011年的数据来看,该比例全球平均为126%,中国处于世界第10;从绝对水平看,中国虽处于世界前列,但不是最高。世界第一的卢森堡,达到489%,比中国高出一倍还不止。排名前25的经济体,既有“欧猪四国”(葡萄牙(Portugal)、意大利(Italy)、希腊(Greece)、西班牙(Spain)),也有货币政策最稳健的德国,多数都是世界人均收入水平较高的国家。美国、俄罗斯、巴西、印度的M2/GDP均低于1,不在前25名。

但是否就能因此认为中国不存在严重的货币超发现象?进一步思考,如果在M2/GDP的比值上,进一步剔除人均收入影响,将会出现怎样一个排名?

21世纪网数据部按比值法,给出一个计算公式:各国的M2/GDP评估系数=(M2/GDP)÷人均GDP*1000。其含义是,均衡人均收入差异后的各国的经济货币化程度。GDP采用世界银行提供的2010年人均GDP数值(2011年数据暂未公布,而2010年的数据并不妨碍观察结果).

计算得出,在M2/GDP超世界平均水平的25个国家中,中国的评估系数最高,瑞士最低。将M2/GDP处于较低水平的美国、俄罗斯、巴西、印度4国也考虑进去,则印度的M2/GDP评估系数最高,美国最低。就各大洲情况来看,亚洲整体的评估系数最高,欧洲次之。

由此可见,当一国的经济货币化程度达到一定程度时,人均收入与之越不匹配,就会使得这个系数扩大。我们将各国的M2/GDP及其评估系数与2012年各个国家的经济状况进行综合分析发现,这一对数字放在一起,可以评估一个国家未来一段时间的经济形态,有一定的警示作用。

欧债危机的发生,与欧洲各国大肆印钞、M2/GDP比值过高存在高度的对应关系。事实上,通货膨胀的深层次原因是财政赤字压力。

葡萄牙、塞浦路斯、西班牙这几个2012年的欧洲重债国,早在2011年,M2/GDP就已超过200%,同时评估系数也属于欧洲的最高梯队。如果观察更早2008年金融危机爆发前的货币供应量,我们会发现它们不约而同出现两位数的陡增。时至今日,这些国家的经济仍未走出低谷。2013年1月欧媒调查显示,西班牙、希腊和葡萄牙的2013年前景比原先设想更加严峻。

这充分显示出,如果危机发生在一个M2/GDP超过200%的经济体,其危害与修复的时间将是长期的。

进一步与评估系数结合,我们发现,评估系数排名较后的爱尔兰、德国、奥地利、法国、比利时、瑞士虽然M2/GDP比值也高达150%,但人均收入高帮助消化了很大一部分压力,而这些国家也刚好是2012年欧元区的经济亮点。

美国的评估系数最低。美国虽然是2008年金融危机的罪魁祸首,但很快能够恢复,最近两个月的失业率已降至近4年低位,其中实体经济与M2/GDP指标稳健帮助甚大。

印度虽然2011年M2/GDP只有0.68,但评估系数高达50.75,位居名单第一位。有经济学家将印度看作“新兴经济体中第一个会崩溃的国家”。去年以来,印度GDP增长大幅下滑,国内通胀严重,同时面临财政赤字和贸易赤字的困扰。

总的来看,M2/GDP占比过大的国家,金融危机与经济危机杀伤力更大,只是累积效应的产生威力,需要提高人均收入来帮助消化压力。

而作为全球最大“印钞机”,中国情况如何?

过去4年,中国货币供应量激增50万亿元,几乎翻番。其与GDP之比,也是一路水涨船高。如果货币总量的扩张节奏跟随实体经济同步变化,即M2与GDP之比大致维持在1.5倍的水平,那么目前75万亿的货币总量就完全足够。但现在,货币总量已足足高出22万亿。

截至2012年年末,中国的M2/GDP达到1.88创下新高。而同期美国的M2余额为10.04万亿美元,截至2012年3季度,GDP为15.81万亿美元。这是什么概念?等于是中国一块钱的货币供应,只撬动了五毛钱的GDP;而美国,一美元拉动最少1.5美元的GDP.

中国评估系数为42.25,仅低于印度,或能说明,中国在经济货币化提高的过程中埋下了不少隐患。具体表现形式有经济领域泡沫资产存在、运营效率低及落后产能过多、贫富差距越来越大、房价与物价调控陷入两难、经济体制结构改革阵痛等。

相比其他国家,中国的货币化速度也过快。根据世界银行的M2/GDP数据显示,美国货币化走势曲折向下,巴西、俄罗斯这些新兴经济体虽然总体趋势向上,但也不如中国货币化率走势陡峭。同花顺[-0.54% 资金 研报]数据显示,M2/GDP从1978年的0.32增长到2012年的1.88,在34年间扩大了近6倍。

此指标也显示中国的货币政策在相当长的时间内难以放松。

2008年以来,为应对全球金融危机,中国是用信贷急剧扩张的方式维系了繁荣。但同时也埋下了货币快速贬值的隐患。当危机意识成为群体性反应的时候,货币的真实购买力就会突然呈现出来,犹如一张美丽的画皮在刹那间脱落而露出狰狞的面容,令人猝不及防。

2005年到2007年10月中国股市大涨,然后又从6100点跌到1600点,这或许跟货币超发到一定程度,而市场无力吸纳大量的货币脱不了干系。当股市无法吸纳时,楼市自然成为另一个吸纳大量货币的“海绵”。房价快速上涨,调控也紧随而至。但国家一边调控,一边却加大货币投放,难以真正抑制房价。央行数据显示,去年中国的新增信贷8.2万亿创出了史上第二峰值。

汹涌的货币总要找到出路口。2012年中国央行已采取稳健的货币政策。即使在CPI下降过程中,央行几次意外地没有采取降息、降准行动。2012年末, M2同比增长13.8%,低于2012年央行制定的14%目标。但现实看来,此前流动性泛滥加之超预期宽松货币政策影响下,2013年的通胀风险仍在不断提升,这也增加物价调控的难度。

最近,日本推出无限量宽松措施无疑是给全球流动性泛滥火上浇油。由于全球处于经济低迷期,日本这一举措可能引发各国进行汇率竞争,中国也面临更大的长期通胀压力。

Wednesday, April 10, 2013

鐵娘子」遇上「鐵男子」

前英國首相,有「鐵娘子」之稱的戴卓爾夫人病逝,在香港正在為2017年的普選問題,展開激烈討論,到底《基本法》對於「普選」二字應該如何解讀之際,一個強而有力的「人證」卻在此時離我們而去。或者當「鐵娘子」與前國家領導人鄧小平在另一個空間相遇的時候,可能會再度為《基本法》的問題再一次爭論,但結果如何,相信沒有人能得知。

對於「鐵娘子」之評價,有人認為她確定了香港於97年回歸所作出的努力,應記一功,但亦有批評認為她沒有捍衛港人的最大權益,只是為了英國爭取最大利益,所以在與中方談判時作出很多退讓。無可否認,在《中英聯合聲明》的談判桌上,戴卓爾夫人明顯輸了給鄧小平,所以如果說戴卓爾夫人是「鐵娘子」,那麼鄧小平絕對是「鐵男子」。

可是,從另一個角度分析,戴卓爾夫人既然是代表英國,所以她為英國爭取利益而非為港人,職責上完全沒有錯誤,唯一可以挑剔的是她沒有盡道義上的責任,但在利益的議題上,又或者面對的是一位成功的政治家,道義責任一向都不應視為談判籌碼。就正如金融海嘯後,至今仍然有不少聲音質疑美國政府為何只將華爾街的利益放在首位,相反實體經濟卻沒有直接受惠美國的救市方案,箇中最大的原因就是過去數十年,華爾街與華府的關係早已變得千絲萬縷,拯救華爾街就等同於維護美國政府的利益,最佳例子是沒有華爾街,美國國債便失去了發行的渠道,這等同於宣布美國政府破產,所以在權衡利益因素後,華府放棄實體經濟利益便變得理所當然。

這是否一種妥協的態度?正確一點說是無奈的做法,就正如昨日所言一樣,經濟與股票市場,一直都被互相牽引,但現在由於被美國聯儲局等央行的貨幣政策扭曲了,因此整個金融市場的發展便變得異常複雜,因為現在美國國債之走向如何,已成為了全球金融市場的一個重要指標,而且無論債價升還是跌,最終的結果都可能是負面。

原因十分簡單,美國國債現在的主要功用,乃是維持美國息率的穩定性,所以如果債價持續高企,不單可以令美國整體的貸款成本維持在低水平,當中包括按揭息率可以低企一段時間,支持美國樓市復甦,但與此同時如果美國債價持續上升或高企,這等同大量資金仍然視美國國債為避險工具,又或者不少投資者仍然只相信美元資產,同時放棄其他投資產品,這只會令全球金融市場的流動性,長期無法受惠聯儲局貨幣政策。

故此,相較而言,美國聯儲局現時的退市問題,遠較98年香港特區政府入市干擾股票市場來得麻煩,原因是任何退市方案,都可能會變成牽一髮而動全身的災難。正如之前所言,投資者的情緒是無法控制的,現在聯儲局卻要估計投資者的想法,絕對是不可能的任務,又或者他們是時候,要求華爾街基於道義協助聯儲局渡過難關。當然,華爾街是否會盡道義?上文已說了很多,所以個人不會抱太大期望。

貨幣紅牛

杜指一日跌,一日升,昨日又升,經濟差股市都唔肯跌。美國就業數據唔理想,反映經濟復覆比預期慢,但股市仍然企於歷史高位無回落,意味著聯儲局的超級貨幣寬鬆政策,只能谷高股市,對實際經濟的改善幫助唔大。不過,聯儲局似乎已經使唔出第二度板斧,只好頂硬上,買時間等運到。投資者睇死聯儲局有排都唔敢收韁,淡友唔敢沽,好友逢低吸納,就出現經濟同股市背馳的奇怪現象。

3月非農就業數據遠差過預期,美股上周先跌後回,只係打個和,昨日走勢又係咁,杜指朝早跳水,隨即有買盤入市撐住,之後一條氣攀升,收市倒升48點;標普500指數漲10點,造1563點,收復上周大部份失地。

美企下周開始公佈第1季業績。市場普遍預期美企今年第1季表現麻麻,不過分析普遍認為對大市影響未必好大,原因係市場對美企盈利預期相對調低,甚至可能因此會出現好多驚喜。TD Ameritrade Holding公司首席衍生品策略基納翰(Joe Kinahan)表示,「企業CEO們已經一再下調盈利預期,盡管超出預期的不一定會得到獎勵,但他們的股票不至於潰敗。」而ING Investment Management公司主管澤姆斯基(Paul Zemsky) 則認為,「人們對企業財報前景的預期非常悲觀,但美國經濟增長率可能會高於2%,那將足夠促進企業盈利增長。」

美國經濟會唔會超過2%增長,有「債券大王」之稱的格羅斯(Bill Gross)就無咁樂觀,他日前表示,美國3月份新增就業人數少於預期,而且,勞動力規模縮小,對推動失業率下降的力量跌至四年以來低點。美國經濟可能會從能源與住宅行業前景好轉當中受益,但這些行業的影響最多只限於一兩個季度,「雖然太陽還沒有落山,但確實已近黃昏」,估計今年的經濟增長率也不會超過2%。

格羅斯在2009年提出「新常態」來描述2009年金融危機後回報降低、政府監管力度加大以及美國在全球經濟領域的影響力下降的時代。格羅斯指出,由美國2013開始加富人稅及政府削減開支,導致上半年經濟增長放緩,美國今年全年增長率將達到1.5%至2%。他稱,「我們沒有投資於我們本應投資的領域,民間又不願在不確定的環境中投資,做成目前全球總需求匱乏。」

私人部門投資需求不足,就由央行印鈔補到夠,先有美國聯儲局,再有日本央行,格羅斯形容這些大泵水行為是「貨幣紅牛」(Monetary Red Bull),佢唔係講緊紅色的牛市,而係所謂能量飲品「紅牛」,大家都知呢係有咖啡因的刺激性飲品,唔夠精神飲佢來提神,但係就無補於虛弱的身子。但呢「貨幣紅牛」可以推動股市大升,金融市場期待東洋口味的紅牛而歡慶中,但信貸猛增、過量流動性正添加環球經濟的「殭屍性」。

「我地唔推薦呢紅牛產品,但要承認佢有能力為金融市場加溫,這些貨幣紅牛短期內令人感受良好,但沒有營養成份,而長遠而言,對資產價值有負面影響。」佢認為零利息最終會拉住經濟增長的後腿,廉價資金導致盈利空間收窄、負增長和裁員。佢指出在70年代頭取消金本位(發行貨幣要以黃金儲備作支持)之後,全球信貸由70年代頭的3萬億美元,猛增到如今的56萬億美元,他質疑信貸猛增和零利率能否長期維持。

我幾鐘意格羅斯呢個「紅牛」比喻,但大家要留意,佢的宏觀分析好大機會正確,美日亂印錢最後救不起經濟,特別是日本,其經濟競爭力遠比美國低下,經濟結構僵化,比美國更難復甦。但短期而言,飲紅牛不會令你倒下,只令你興。

3月非農就業數據遠差過預期,美股上周先跌後回,只係打個和,昨日走勢又係咁,杜指朝早跳水,隨即有買盤入市撐住,之後一條氣攀升,收市倒升48點;標普500指數漲10點,造1563點,收復上周大部份失地。

美企下周開始公佈第1季業績。市場普遍預期美企今年第1季表現麻麻,不過分析普遍認為對大市影響未必好大,原因係市場對美企盈利預期相對調低,甚至可能因此會出現好多驚喜。TD Ameritrade Holding公司首席衍生品策略基納翰(Joe Kinahan)表示,「企業CEO們已經一再下調盈利預期,盡管超出預期的不一定會得到獎勵,但他們的股票不至於潰敗。」而ING Investment Management公司主管澤姆斯基(Paul Zemsky) 則認為,「人們對企業財報前景的預期非常悲觀,但美國經濟增長率可能會高於2%,那將足夠促進企業盈利增長。」

美國經濟會唔會超過2%增長,有「債券大王」之稱的格羅斯(Bill Gross)就無咁樂觀,他日前表示,美國3月份新增就業人數少於預期,而且,勞動力規模縮小,對推動失業率下降的力量跌至四年以來低點。美國經濟可能會從能源與住宅行業前景好轉當中受益,但這些行業的影響最多只限於一兩個季度,「雖然太陽還沒有落山,但確實已近黃昏」,估計今年的經濟增長率也不會超過2%。

格羅斯在2009年提出「新常態」來描述2009年金融危機後回報降低、政府監管力度加大以及美國在全球經濟領域的影響力下降的時代。格羅斯指出,由美國2013開始加富人稅及政府削減開支,導致上半年經濟增長放緩,美國今年全年增長率將達到1.5%至2%。他稱,「我們沒有投資於我們本應投資的領域,民間又不願在不確定的環境中投資,做成目前全球總需求匱乏。」

私人部門投資需求不足,就由央行印鈔補到夠,先有美國聯儲局,再有日本央行,格羅斯形容這些大泵水行為是「貨幣紅牛」(Monetary Red Bull),佢唔係講緊紅色的牛市,而係所謂能量飲品「紅牛」,大家都知呢係有咖啡因的刺激性飲品,唔夠精神飲佢來提神,但係就無補於虛弱的身子。但呢「貨幣紅牛」可以推動股市大升,金融市場期待東洋口味的紅牛而歡慶中,但信貸猛增、過量流動性正添加環球經濟的「殭屍性」。

「我地唔推薦呢紅牛產品,但要承認佢有能力為金融市場加溫,這些貨幣紅牛短期內令人感受良好,但沒有營養成份,而長遠而言,對資產價值有負面影響。」佢認為零利息最終會拉住經濟增長的後腿,廉價資金導致盈利空間收窄、負增長和裁員。佢指出在70年代頭取消金本位(發行貨幣要以黃金儲備作支持)之後,全球信貸由70年代頭的3萬億美元,猛增到如今的56萬億美元,他質疑信貸猛增和零利率能否長期維持。

我幾鐘意格羅斯呢個「紅牛」比喻,但大家要留意,佢的宏觀分析好大機會正確,美日亂印錢最後救不起經濟,特別是日本,其經濟競爭力遠比美國低下,經濟結構僵化,比美國更難復甦。但短期而言,飲紅牛不會令你倒下,只令你興。

Monday, April 8, 2013

兩張包贏的賭枱

當22000及21800點兩大重要支持位都相繼跌穿,淡友借H7N9、內地影子銀行等問題加大空倉,於4月的第一個星期終於旗開得勝。A股連休兩日,外圍中資股就跌勢未止,連H股指數250日平均線亦告失守,從好的方面去想,有兩個情況可能出現:一、超賣後的技術反彈;二、中資專責托市小組勢將出動。

過往經驗,外圍淡風越寒,內地股市就越會趨向回暖。以內地的作風,面對外界群起攻之就會力撐,A股本周復市後,會否出現爆升,繼而扭轉港股跌勢,就且拭目以待。

資金湧日 中資股失血

上周五,因為航空股急挫、醫藥股抽升,令內地疫情擴大引發市況恐慌性沽售之說,更加言之鑿鑿。但觀乎恒指一周僅三個交易日就可跌2.57%、大市沽空比率連日超過12%,似乎空軍是有備而來。而上周五跌勢之急,不限於本港,其實極可能是市場深明日本央行銀彈政策擾亂區內經濟,導致資金流向急劇變動所致,但跌市要有藉口,於是才找上H7N9。

有金融界人士形容,目前全球市場形同有兩張保證贏錢的賭枱,一張在美國,另一張位於日本,前者保證債市贏錢,後者短線包保股市賺錢。所以儘管游資充斥,單是兩張賭枱已經吸走大量資金了。年初曾經談過,日股之得,已成中資股之失。根據最新數字統計,單是過去四星期,傳統基金淨流入日股金額有55億美元,反而中資股資金淨外流逾8億美元,很明顯買日股、沽中資已成為大戶主要策略。外界部份評論仍然流於質疑日本巨額量寬對刺激經濟的成效,但在在忽略如此大規模印鈔,刺激股市的命中率近乎百分百,再者日圓越弱,日企盈利越高,兩者過往廿年關連系數極高。

過往經驗,外圍淡風越寒,內地股市就越會趨向回暖。以內地的作風,面對外界群起攻之就會力撐,A股本周復市後,會否出現爆升,繼而扭轉港股跌勢,就且拭目以待。

資金湧日 中資股失血

上周五,因為航空股急挫、醫藥股抽升,令內地疫情擴大引發市況恐慌性沽售之說,更加言之鑿鑿。但觀乎恒指一周僅三個交易日就可跌2.57%、大市沽空比率連日超過12%,似乎空軍是有備而來。而上周五跌勢之急,不限於本港,其實極可能是市場深明日本央行銀彈政策擾亂區內經濟,導致資金流向急劇變動所致,但跌市要有藉口,於是才找上H7N9。

有金融界人士形容,目前全球市場形同有兩張保證贏錢的賭枱,一張在美國,另一張位於日本,前者保證債市贏錢,後者短線包保股市賺錢。所以儘管游資充斥,單是兩張賭枱已經吸走大量資金了。年初曾經談過,日股之得,已成中資股之失。根據最新數字統計,單是過去四星期,傳統基金淨流入日股金額有55億美元,反而中資股資金淨外流逾8億美元,很明顯買日股、沽中資已成為大戶主要策略。外界部份評論仍然流於質疑日本巨額量寬對刺激經濟的成效,但在在忽略如此大規模印鈔,刺激股市的命中率近乎百分百,再者日圓越弱,日企盈利越高,兩者過往廿年關連系數極高。

YZJ new contracts

" Another China’s large private-owned Yangzijiang Shipbuilding is said to have won a $170m worth of jack-up drilling rig from a Malaysian shipowner at the end of last year, entering offshore sector for the first time and to top it off, Yangzijiang signed a preliminary agreement for one jack-up drilling rig with Qatar Investment Corporation. "

Qatar Investment corporation agreement news seems haven't release yet.

Also, sources said the shipowner secures additional options for four of same size at the yard.

Frontline 2012 is aggressively investing in newbuilding capesize fleet and has placed most of orders at Chinese shipyards, such as SWS, DSIC, and Yangzijiang Shipbuilding. If the owner firms up options and those signed by LOI, then it would have a total of 32 capesize bulkers on order.

Both news are last two days and seems more order will be seeing soon.

China's privately-owned shipyard Jiangsu New Yangzi Shipbuilding has won a newbuilding order to build up to five kamsarmax bulkers from Callimanopulos group.

An official from the Greek owner said the company recently placed an order for firm three 82,000-dwt bulkers and additional options for one plus one units.

The firm newbuildings are to be delivered in August and October of 2015 and January 2016 respectively.

Callimanopulos did not disclosed the price, while industry player estimated the ship to value around $26m apiece.

Qatar Investment corporation agreement news seems haven't release yet.

Also, sources said the shipowner secures additional options for four of same size at the yard.

Frontline 2012 is aggressively investing in newbuilding capesize fleet and has placed most of orders at Chinese shipyards, such as SWS, DSIC, and Yangzijiang Shipbuilding. If the owner firms up options and those signed by LOI, then it would have a total of 32 capesize bulkers on order.

Both news are last two days and seems more order will be seeing soon.

New Yangzi Pens Kamsarmax

China's privately-owned shipyard Jiangsu New Yangzi Shipbuilding has won a newbuilding order to build up to five kamsarmax bulkers from Callimanopulos group.

An official from the Greek owner said the company recently placed an order for firm three 82,000-dwt bulkers and additional options for one plus one units.

The firm newbuildings are to be delivered in August and October of 2015 and January 2016 respectively.

Callimanopulos did not disclosed the price, while industry player estimated the ship to value around $26m apiece.

Sunday, April 7, 2013

Yangzijiang Shipbuilding (Holdings) Ltd

NOTICE OF ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN that the Annual General Meeting of the Company will be held at Olivia Ballroom,Level 4, Raffles City Convention Centre, 80 Bras Basah Road, Singapore 189560 on Friday, 26 April 2013 at 2.30 p.m. to transact the following business:–

ORDINARY BUSINESS

1. To receive, consider and adopt the Audited Financial Statements for the financial year ended 31 December 2012 and the Directors’ Reports and the Auditors’ Report thereon. (Resolution 1)

2. To declare a tax exempt (one-tier) final dividend of S$0.05 per ordinary share in respect of the financial year ended 31 December 2012. (Resolution 2)

3. To approve the proposed Directors’ fees of S$90,000 for the financial year ended 31 December 2012 (2011: S$90,000). (Resolution 3)

4. To record the retirement of Mr Teo Moh Gin as Director of the Company pursuant to Article 94 of the Articles of Association of the Company who will not be seeking for re-election.

5. To re-appoint Messrs PricewaterhouseCoopers LLP as Auditors and to authorise the Directors to fix their remuneration. (Resolution 4)

SPECIAL BUSINESS

To consider and, if thought fit, to pass the following Ordinary resolutions, with or without modifications:

6. AUTHORITY TO ALLOT AND ISSUE SHARES

“That pursuant to Section 161 of the Companies Act, Chapter 50 and the listing rules of the Singapore Exchange Securities Trading Limited (“SGX-ST”), authority be and is hereby given to the Directors of the Company to:

(a) (i) issue ordinary shares in the capital of the Company (“Shares”) whether by way of rights, bonus or otherwise; and/or

(ii) make or grant offers, agreements or options (collectively, “Instruments”) that might or would require Shares to be issued, including but not limited to the creation and issue of (as well as adjustments to) warrants, debentures or other instruments convertible into Shares, at any time and upon such terms and conditions and for such purposes and to such persons as the Directors may, in their absolute discretion, deem fit; and

(b) issue Shares in pursuance of any Instruments made or granted by the Directors while such authority was in force (notwithstanding that such issue of Shares pursuant to the Instruments may occur after the expiration of the authority contained in this resolution).

provided that:

(1) the aggregate number of the Shares to be issued pursuant to such authority (including the Shares to be issued in pursuance of Instruments made or granted pursuant to such authority), does not exceed 50% of the total number of issued Shares (as calculated in accordance with paragraph (2) below), and provided further that where shareholders of the Company (“Shareholders”) are not given the opportunity to participate in the same on a pro-rata basis (“non pro-rata basis”), then the Shares to be issued under such circumstances (including the Shares to be issued in pursuance of Instruments made or granted pursuant to such authority) shall not exceed 20% of the total number of issued Shares (as calculated in accordance with paragraph (2) below);

(2) (subject to such manner of calculation as may be prescribed by the SGX-ST) for the purpose of determining the aggregate number of the Shares that may be issued under paragraph (1) above, the total number of issued Shares shall be based on the issued Shares of the Company (excluding treasury shares) at the time such authority was conferred, after adjusting for:

(a) new Shares arising from the conversion or exercise of any convertible securities;

(b) new Shares arising from the exercising share options or the vesting of share awards which are outstanding or subsisting at the time such authority was conferred; and

(c) any subsequent consolidation or subdivision of the Shares; and, in relation to an Instrument, the number of Shares shall be taken to be that number as would have been issued had the rights therein been fully exercised or effected on the date of the making or granting of the Instrument;

(3) in exercising the authority conferred by this Resolution, the Company shall comply with the requirements imposed by the SGX-ST from time to time and the provisions of the Listing Manual of the SGX-ST for the time being in force (in each case, unless such compliance has been waived by the SGX-ST), all applicable legal requirements under the Companies Act and otherwise, and the Articles of Association of the Company for the time being; and

(4) (unless revoked or varied by the Company in a general meeting) the authority so conferred shall continue in force until the conclusion of the next Annual General Meeting of the Company or the date by which the next Annual General Meeting of the Company is required by law to be held, whichever is earlier.” (Resolution 5)

7. RENEWAL OF SHARE PURCHASE MANDATE

“That:

(a) the exercise by the Directors of the Company of all the powers of the Company to purchase or otherwise acquire issued Ordinary Shares not exceeding in aggregate the Maximum Limit (as hereafter defined), at such price or prices as may be determined by the Directors of the Company from time to time up to the Maximum Price (as hereafter defined), whether by way of:

(i) market purchase(s) on the SGX-ST; and/or

(ii) off-market purchase(s) (if effected otherwise than on the SGX-ST) in accordance with any equal access scheme(s) as may be determined or formulated by the Directors of the Company as they consider fit, which scheme(s) shall satisfy all the conditions prescribed by the Companies Act; and otherwise in accordance with all other laws and regulations and rules of the SGX-ST as may for the time being be applicable, be and is hereby authorised and approved generally and unconditionally (the “Share Purchase Mandate”),

(b) unless varied or revoked by the Company in general meeting, the authority conferred on the Directors of the Company pursuant to the Share Purchase Mandate may be exercised by the Directors of the Company at any time and from time to time during the period commencing from the date of the passing of this Resolution and expiring on the earlier of:

(i) the date on which the next Annual General Meeting of the Company is held; or

(ii) the date by which the next Annual General Meeting of the Company is required by law to be held; or

(iii) the date on which the purchases or acquisitions of the Shares pursuant to Share Purchase Mandate are carried out to the full extent mandated.

(c) in this Resolution:

“Maximum Limit” means that number of issued Ordinary Shares representing 10% of the total number of the issued Ordinary Shares as at the date of the passing of this Resolution (excluding any Ordinary Shares which are held as treasury shares as at that date); “Maximum Price”, in relation to an Ordinary Share to be purchased or acquired, means the purchase price (excluding brokerage, commission, applicable goods and services tax and other related expenses) which shall not exceed:–

(i) in the case of a Market Purchase, 105% of the Average Closing Price (as defined hereinafter); and

(ii) in the case of an Off-Market Purchase, 120% of Average Closing Price (as defined hereinafter), pursuant to an equal access scheme; “Average Closing Price” means the average of the closing market prices of a Share for the five consecutive Market Days on which the Shares are transacted on the SGX-ST immediately preceding the date of Market Purchase by the Company or, as the case may be, the date of the making of the offer pursuant to the Off-Market Purchase, and deemed to be adjusted in accordance with the Listing Rules for any corporate action which occurs after the relevant five Market Days; “date of the making of the offer” means the date on which the Company announces its intention to make an offer for an Off-Market Purchase, stating therein the purchase price (which shall not be more than the Maximum Price for an Off-Market Purchase calculated on the foregoing basis) for each Share and the relevant terms of the equal access scheme for effecting the Off-Market Purchase;

(d) the Directors of the Company and/or any of them be and are hereby authorised to complete and do all such acts and things (including executing such documents as may be required) as they and/ or he may consider expedient or necessary to give effect to the transactions contemplated and/or authorised by this Resolution.” (Resolution 6)

8. To transact any other business which may be properly transacted at an Annual General Meeting.

By Order of the Board

Pan Mi Keay

Company Secretary

28 March 2013

Singapore

STATEMENT PURSUANT TO ARTICLE 56 OF THE COMPANY’S ARTICLE OF ASSOCIATION:–

The effects of the resolutions under the heading “Ordinary Business” and “Special Business” in this Notice

of Annual General Meeting are:

(a) The proposed ordinary resolution 5 if passed, will empower the Directors of the Company from the date of the above meeting to issue shares in the Company up to an amount not exceeding in total 50% of the total number of issued shares in the capital of the Company with a sub-limit of 20% other than on a pro-rata basis to shareholders for the time being for such purposes as they consider would be in the interest of the Company. The authority will, unless previously revoked or varied at a general meeting, expire at the next Annual General Meeting of the Company.

(b) The proposed ordinary resolution 6 if passed, will empower the Directors of the Company from the date of the above meeting until the date of the next Annual General Meeting to purchase or acquire up to 10% of the issued ordinary share capital of the Company as at the date of the passing of this Resolution. Details of the proposed Share Purchase Mandate are set out in the Appendix I to the Notice of the above meeting.

(i) As at the date of this Notice, the Company has not purchased any share by way of market acquisition

for cancellation.

(ii) The amount of financing required for the Company to further purchase or acquire its shares, and the impact on the Company’s financial position, cannot be ascertained as at the date of this Notice as this will depend on the number of the shares purchased or acquired and the price at which such shares were purchased or acquired.

(iii) The financial effects of the purchase or acquisition of shares by the Company pursuant to the proposed Share Purchase Mandate on the Group’s audited financial statements for the financial year ended 31 December 2012 are set out in Appendix I to the Notice of the above meeting and are for illustration only.

Friday, April 5, 2013

The Weis Wave Plugin

The Weis Wave Plugin stands head and shoulders above anything currently available to the trading community. I have been trading for 25 years and have used the Weis Wave for the past three. With its unique wave volume, the Weis Wave helps traders recognize turning points. —Alfred T., Austria

I have to tell you that your Weis Wave has been EXTREMELY useful!

I’ve been trading for a living for over 15 years now… this tool you have provided has made things much clearer to me. —T.K.

The Weis Wave Plugin is the end product of 30 years work to find the most accurate portrayal of volume. The insights gained from this plugin are a great help in anticipating trend changes of varying degree.

Anyone who has watched intraday price movement knows it unfolds in a series of buying and selling waves—a process of building up and tearing down. Prices do not unfold in bundles of equal time. When the natural movement of prices is bound by time, the trend still remains visible. Volume, however, does not fare so well. Subdividing volume into time periods obscures the true force of the buying and selling. The Weis Wave Plugin creates wave charts along with their corresponding wave volume.

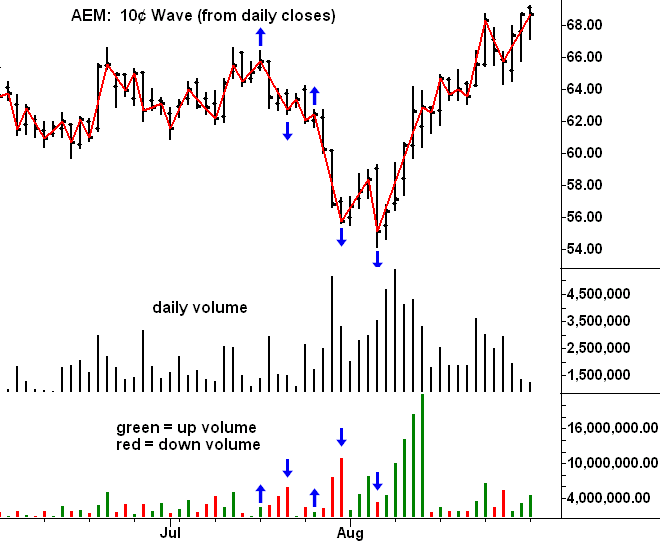

Wave charts were first created by Richard D. Wyckoff. In his famous course on stock market technique, he instructed students to “think in waves.” Wave analysis was an integral part of his trading method. The Weis Wave is an adaptation of Wyckoff’s method that handles today’s volatile markets. It works in all time periods and can be applied to the futures, forex, stock, and commodity markets. You will be amazed at how well the Weis Waveidentifies turning points. Many of these same turning points are not obvious on conventional bar charts. Take a look at the daily stock chart of AEM:

Moving from left to right, the first arrow refers to a two day up-wave that ends on July 18. The cumulative volume equals 2.5 million shares. It stands out as a low volume test of the previous up-wave. On the sell-off from this high, the wave volume exceeds all preceding volumes either up or down. Notice the daily volumes do not show such a change in behavior. The third arrow points to a minute, one-day rally with wave volume of 1.75 million shares, the lowest since June 27. It shouts out NO DEMAND. Prices fall about $9 in the next three days and the fourth arrow points to the climactic action.

Notice the next up-wave. It is propelled by the heaviest up-wave volume to date. Here, for the first time, demand appears. This message does not stand out with such clarity on the volume histogram. The last arrow points to the August 4 low made on a one-day decline. Daily volume and wave volume are the same. Yet in the context of the preceding down-waves, the wave volume is very low. Of the three highlighted down-waves, it has the smallest volume and says supply is spent.

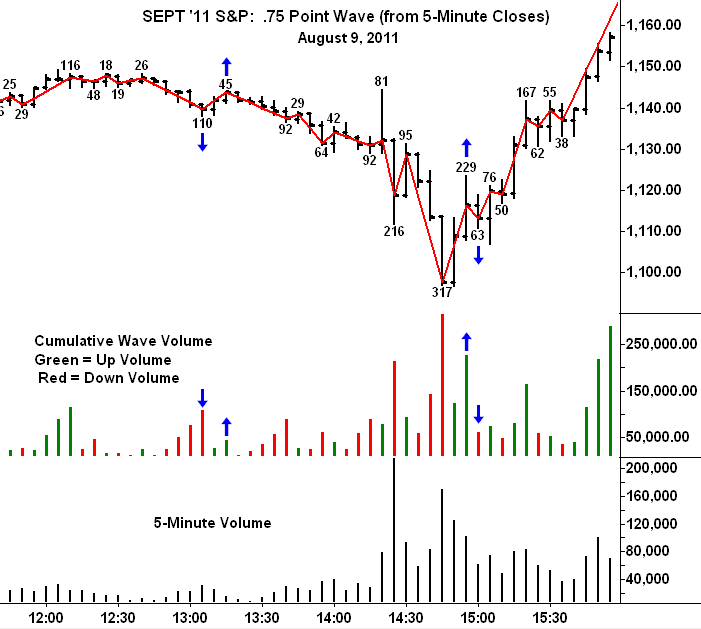

Many of the trades made with the Weis Wave involve pullbacks. For example, when price falls on heavy volume, this is a bearish change in behavior. If the wave volume on the next pullback diminishes sharply, a short trade is established with a close protective stop. This is the case on the September S&P chart where price falls on 110k volume shortly after 13:00. This is the heaviest volume in several hours. The relatively weak volume on the pullback reflects lack of demand. A great short trade unfolded from this high. The five-minute volume reveals none of this information. After the decline below 1100 around 14:45, the next up-wave draws out 229k contracts, an overtly bullish change in behavior. On the next pullback, volume shrinks to 63k, a sign the selling pressure has dried up. The rally from this low hit 1170 on the close!

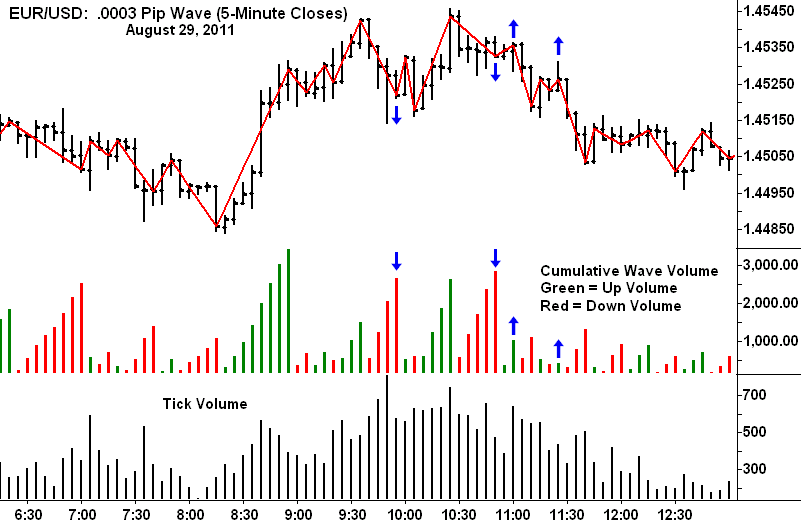

Weis Wave works equally well on Forex charts. The setup on the Euro 5-minute chart is classic. It begins with heavy selling on the decline to the 9:50 a.m. low. After a failed attempt to renew the uptrend, the Euro falls on even larger volume. This is the bearish change in behavior. It is followed by two small, low volume up-waves that can be used to establish short positions. The combination of a bullish or bearish change in behavior followed by a low-volume pullback produces a multitude of trades. Suddenly, you can trade like a counter-puncher.

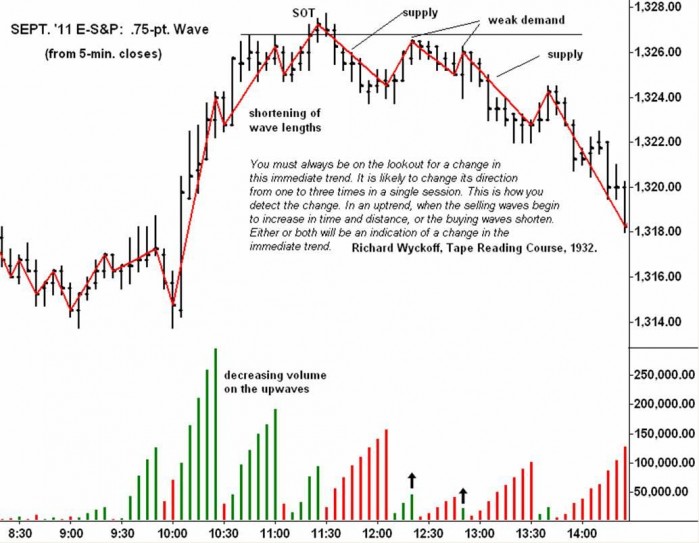

In the week of June 20, the actual volumes all look the same. They look like the tree line on the horizon, a phenomenon typical of many stock charts. The wave volume gives a truer picture of the reduced selling pressure at the low. Notice the leap in wave volume on the first upwave off the low. It reflects aggressive demand and leads to a nice 10% profit.

Because the daily prices are visible, the chart reader can combine the message of the wave volume with the length of the bars and the position of the close—a powerful combination.

I have to tell you that your Weis Wave has been EXTREMELY useful!

I’ve been trading for a living for over 15 years now… this tool you have provided has made things much clearer to me. —T.K.

The Weis Wave Plugin is the end product of 30 years work to find the most accurate portrayal of volume. The insights gained from this plugin are a great help in anticipating trend changes of varying degree.

Anyone who has watched intraday price movement knows it unfolds in a series of buying and selling waves—a process of building up and tearing down. Prices do not unfold in bundles of equal time. When the natural movement of prices is bound by time, the trend still remains visible. Volume, however, does not fare so well. Subdividing volume into time periods obscures the true force of the buying and selling. The Weis Wave Plugin creates wave charts along with their corresponding wave volume.

Wave charts were first created by Richard D. Wyckoff. In his famous course on stock market technique, he instructed students to “think in waves.” Wave analysis was an integral part of his trading method. The Weis Wave is an adaptation of Wyckoff’s method that handles today’s volatile markets. It works in all time periods and can be applied to the futures, forex, stock, and commodity markets. You will be amazed at how well the Weis Waveidentifies turning points. Many of these same turning points are not obvious on conventional bar charts. Take a look at the daily stock chart of AEM:

Moving from left to right, the first arrow refers to a two day up-wave that ends on July 18. The cumulative volume equals 2.5 million shares. It stands out as a low volume test of the previous up-wave. On the sell-off from this high, the wave volume exceeds all preceding volumes either up or down. Notice the daily volumes do not show such a change in behavior. The third arrow points to a minute, one-day rally with wave volume of 1.75 million shares, the lowest since June 27. It shouts out NO DEMAND. Prices fall about $9 in the next three days and the fourth arrow points to the climactic action.

Notice the next up-wave. It is propelled by the heaviest up-wave volume to date. Here, for the first time, demand appears. This message does not stand out with such clarity on the volume histogram. The last arrow points to the August 4 low made on a one-day decline. Daily volume and wave volume are the same. Yet in the context of the preceding down-waves, the wave volume is very low. Of the three highlighted down-waves, it has the smallest volume and says supply is spent.

Many of the trades made with the Weis Wave involve pullbacks. For example, when price falls on heavy volume, this is a bearish change in behavior. If the wave volume on the next pullback diminishes sharply, a short trade is established with a close protective stop. This is the case on the September S&P chart where price falls on 110k volume shortly after 13:00. This is the heaviest volume in several hours. The relatively weak volume on the pullback reflects lack of demand. A great short trade unfolded from this high. The five-minute volume reveals none of this information. After the decline below 1100 around 14:45, the next up-wave draws out 229k contracts, an overtly bullish change in behavior. On the next pullback, volume shrinks to 63k, a sign the selling pressure has dried up. The rally from this low hit 1170 on the close!

Weis Wave works equally well on Forex charts. The setup on the Euro 5-minute chart is classic. It begins with heavy selling on the decline to the 9:50 a.m. low. After a failed attempt to renew the uptrend, the Euro falls on even larger volume. This is the bearish change in behavior. It is followed by two small, low volume up-waves that can be used to establish short positions. The combination of a bullish or bearish change in behavior followed by a low-volume pullback produces a multitude of trades. Suddenly, you can trade like a counter-puncher.

S&P Chart

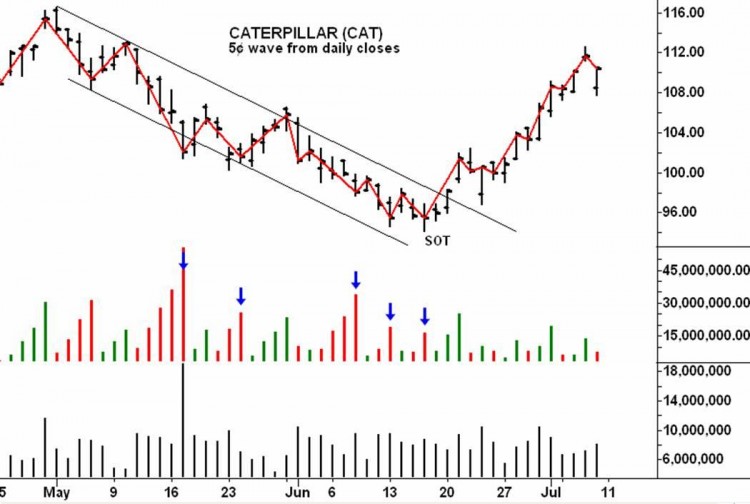

The intraday volatility in the E-S&P makes it a favorite among day traders. Some of the best wave volume setups appear in this contract. Wednesday, July 13 created a number of such trading opportunities. On the 5-minute bar chart of the September ‘11 contract, a .75-point wave is included. In the middle of the chart, I have copied Wyckoff’s statement on how to recognize intraday changes in trend. They are central to reading the wave chart and volume. Within the uptrend on the left-hand side of the chart, you can readily see how the wave lengths and wave volumes diminish as prices move higher. At the top of the third upwave—where the thrust shortens, the wave length decreases in size and the wave volume drops—short positions should have been established. The first downwave from this high draws out massive supply—the heaviest of the day. On the subsequent two rallies, demand evaporated thus offering additional entry points for new shorts. The second of these two upwaves consists of only one 5-minute bar. Without the bearish picture of the wave volume, the strong close on that bar might have caused some traders to close out short positions. Because the waves filter price data, they are not as ephemeral as the price bars. Supply is dominant throughout the rest of the session.Caterpillar Chart

On the daily CAT chart, the wave volume shows how the selling gradually slackens as prices decline to the June low. The bar chart shows the shortening of the downward thrust near the bottom of the price channel. Below the price chart you first see the cumulative wave volume and then the actual, daily volume.In the week of June 20, the actual volumes all look the same. They look like the tree line on the horizon, a phenomenon typical of many stock charts. The wave volume gives a truer picture of the reduced selling pressure at the low. Notice the leap in wave volume on the first upwave off the low. It reflects aggressive demand and leads to a nice 10% profit.

Because the daily prices are visible, the chart reader can combine the message of the wave volume with the length of the bars and the position of the close—a powerful combination.

留心日圓效應

日央行開始印鈔,日圓將外流,先得益者為美國國債,美10年國債息已低見1.76厘,跟月多前的逾2厘對比,是低了很多。

跟著應受益者應是澳元、紐元,其年息逾3厘,用日圓換澳、紐元,可以賺息賺價。

跟著的是買人民幣?年息逾3厘,有一定升值潛力,理應可買,但基於政治理由,又未必會很熱心。

跟香港有關的,是日資會否買港股,尤其是高息港股,日資當然亦有政治考慮,但考慮應較少。

跟著應受益者應是澳元、紐元,其年息逾3厘,用日圓換澳、紐元,可以賺息賺價。

跟著的是買人民幣?年息逾3厘,有一定升值潛力,理應可買,但基於政治理由,又未必會很熱心。

跟香港有關的,是日資會否買港股,尤其是高息港股,日資當然亦有政治考慮,但考慮應較少。

Wednesday, April 3, 2013

Why is Elliott Wave so Useful?

| The most accurate method of forecasting The first time I came into contact with Elliott Wave was in my first seminar on technical analysis by a U.K. analyst. After the two day introductory course to analysis I returned to my trading room full of enthusiasm, armed with all the patterns and techniques this guru had imparted upon the fledgling analysts, ready to take the market by storm. However, he clearly he didn't think very much about the principal since his only comment was "wave bye-bye to Elliott Wave." So what did I have left? Golden crosses and dead crosses. Tried those - they were almost 100% the opposite of what he taught. Overbought & oversold momentum. Well good but they don't tell you where price is going and perform so badly in a trend. Reversal patterns and continuation patterns. Well they didn't happen that frequently and what were you meant to do in the meantime? My traders wanted to know where price was going to go. I began to read more. Ah! Fibonacci! 38.2% and 61.8% - wow they worked really well… I thought I found the secret elixir to the fountain of profits… Then they suddenly didn't work. Desperate for clues I read other analysts' commentary on the data vendor platforms. Some provided anemic comments while others actually forecast exact targets and how it would reach there. Some were ok, some were bad (but enthusiastic) and some were actually pretty good. This fascinated me. Who were these guys that were actually forecasting where price would go? How did they do that? The answer was Elliott Wave and it was these services that actually provided real information and had the greatest rate of success. So I decided to read about Elliott Wave and tried to teach myself. Of course I didn't tell my guru - I didn't want to incur his wrath. I can guess what some of you are thinking, "yeah, yeah, 12345 ABC." Well basically, yes. But it is a lot more. I bought a couple of books, devoured them and went to my charts to decipher and scribble numbers and letters all over them. It wasn't as easy as the books made them out to be. It was a struggle trying to decide where waves started and ended and how far they would move and I did give up for a period but the problem was that nothing else really gave true forecasting techniques. So I persisted. I did my analysis and I read other banks' forecasts and tried to work out why they were right - or indeed, why they were wrong. I have to say it took me around 18 months before I felt comfortable using the principal to forecast, and even then it was still a little hit & miss. As with any form of analysis there are good points about Elliott Wave and there are bad points. The bad points are: The counting of waves can be very subjective. There is a common joke that says: "Place 5 Ellioticians in a room with 1 chart for one hour and they'll come out with 20 different wave counts". True… The development of individual waves can vary dramatically The experience required to recognize the type of variation takes a good few years and a great deal of patience to acquire Sometimes waves are impossible to recognize Filtering wave counts to obtain the most likely ones can be difficult Elliott's description of the wave structure is actually incorrect for Foreign Exchange - a fact that took me many years to realize Once you start using the principal it is impossible to look at a chart without counting waves… It can cause you to make incredibly inaccurate forecasts if not utilized properly. (I recall one analyst that called USDDEM higher from 1.72 to 2.46 and 3.46… it actually went down to 1.44…) Against that the good points are: Elliott Wave can predict market moves to the point at times - nothing else can Waves are related and thus you can use Fibonacci relationships to recognize waves, where they started and where they have greatest chance of ending It tells you how a move will occur. This is vital It will warn you that your wave count may be breaking down if the wave development doesn't go as planned It is the only form of analysis (that I know of) that gives you an understanding of market behavior as if it is an extension of a living force The principal helps an analyst/trader to understand the structure of a market from monthly charts down to 1 minute charts, a reflection of the fractal nature of markets. It can provide incredibly easy trades from time to time just using basic guidelines The biggest element to success with Elliott Wave, apart from several years of experience, is understanding how to filter your wave counts. The very best way is to understand the cyclical nature of the market forces. If the analyst who had predicted USDDEM to move higher to 2.46 and 3.46 had incorporated cyclic analysis he would have seen that the major cyclic pressure was still lower. That in itself will keep you closer to the right count. Cycles have assisted me in recognizing direction to moves and when they should reverse - which combined with Fibonacci projections to structures can allow precise forecasting. Momentum analysis can help you recognize when the pattern you have been following is breaking down and become more complex. Even a basic guidelines that the last Wave B will provide approximate support or resistance on retest can produce excellent trading opportunities. So now what are you waiting for? Go pick up a book on the Principal but remember nothing is easy in this market and it will take time and dedication. If there was a simple solution then everyone would use it. If everyone used it, then it probably wouldn't work so well… |

Wyckoff Market Analysis

Richard D. Wyckoff, a perpetual stock market student, was a great trader and a pioneer of technical analysis. Based on his theories, studies and real life experiences, Wyckoff developed a trading methodology that has stood the test of time. Wyckoff started with a broad market assessment and then drilled down to find stocks with the most profit potential. This article, the first of two, details Wyckoff's approach to broad market analysis. It is important to understand the broad market trend and the position within this trend before selecting individual stocks. The second article shows how Wyckoff selected stocks to buy and sell. This second article will be posted by the end of February 2012.

Richard Wyckoff began his Wall Street career in 1888 as a runner scurrying back and forth between firms with documents. As with Jesse Livermore in the bucket shops, Wyckoff learned to trade by watching the action first hand. His first trade occurred in 1897 when he bought one share of St. Louis & San Francisco common stock. After successfully trading his own account several years, he opened a brokerage house and started publishing research in 1909. The Magazine of Wall Street was one of the first, and most successful, newsletters of the time. As an active trader and analyst in the early 1900s, his career coincided with other Wall Street greats including Jesse Livermore, Charles Dow and JP Morgan. May have called this the "golden age of technical analysis". As his stature grew, Wyckoff published two books on his methodology: Studies in Tape Reading (1910) and How I Trade and Invest in Stocks and Bonds (1924). In 1931, Wyckoff published a correspondence course detailing the methodology he developed over his illustrious career.

Two Rules

Wyckoff focused exclusively on price action. Earnings and other fundamental information were simply too esoteric and imprecise to be used effectively. Moreover, this information was usually already factored into the price by the time it became available to the average speculator. Before looking at the details, there are two rules to keep in mind. These rules come directly from the book, Charting the Stock Market: The Wyckoff Method, by Jack K. Hutson, David H. Weiss and Craig F. Schroeder.

Rule One: Don't expect the market to behave exactly the same way twice. The market is an artist, not a computer. It has a repertoire of basic behavior patterns that it subtly modifies, combines and springs unexpectedly on its audience. A trading market is an entity with a mind of its own.

Rule Two: Today's market behavior is significant only when it's compared to what the market did yesterday, last week, last month, even last year. There are no predetermined, never-fail levels where the market always changes. Everything the market does today must be compared to what it did before.

Instead of steadfast rules, Wyckoff advocated broad guidelines when analyzing the stock market. Nothing in the stock market is definitive. After all, stock prices are driven by human emotions. We cannot expect the exact same patterns to repeat over time. There will, however, be similar patterns or behaviors that astute chartists can profit from. Chartists should keep the following guidelines in mind and then apply their own judgments to develop a trading strategy.

Richard Wyckoff began his Wall Street career in 1888 as a runner scurrying back and forth between firms with documents. As with Jesse Livermore in the bucket shops, Wyckoff learned to trade by watching the action first hand. His first trade occurred in 1897 when he bought one share of St. Louis & San Francisco common stock. After successfully trading his own account several years, he opened a brokerage house and started publishing research in 1909. The Magazine of Wall Street was one of the first, and most successful, newsletters of the time. As an active trader and analyst in the early 1900s, his career coincided with other Wall Street greats including Jesse Livermore, Charles Dow and JP Morgan. May have called this the "golden age of technical analysis". As his stature grew, Wyckoff published two books on his methodology: Studies in Tape Reading (1910) and How I Trade and Invest in Stocks and Bonds (1924). In 1931, Wyckoff published a correspondence course detailing the methodology he developed over his illustrious career.

Two Rules

Wyckoff focused exclusively on price action. Earnings and other fundamental information were simply too esoteric and imprecise to be used effectively. Moreover, this information was usually already factored into the price by the time it became available to the average speculator. Before looking at the details, there are two rules to keep in mind. These rules come directly from the book, Charting the Stock Market: The Wyckoff Method, by Jack K. Hutson, David H. Weiss and Craig F. Schroeder.

Rule One: Don't expect the market to behave exactly the same way twice. The market is an artist, not a computer. It has a repertoire of basic behavior patterns that it subtly modifies, combines and springs unexpectedly on its audience. A trading market is an entity with a mind of its own.

Rule Two: Today's market behavior is significant only when it's compared to what the market did yesterday, last week, last month, even last year. There are no predetermined, never-fail levels where the market always changes. Everything the market does today must be compared to what it did before.

Instead of steadfast rules, Wyckoff advocated broad guidelines when analyzing the stock market. Nothing in the stock market is definitive. After all, stock prices are driven by human emotions. We cannot expect the exact same patterns to repeat over time. There will, however, be similar patterns or behaviors that astute chartists can profit from. Chartists should keep the following guidelines in mind and then apply their own judgments to develop a trading strategy.

Broad Market Trend