Like most normal days, I love to do my work at Costa Coffee – a nice, cosy place where I can concentrate on my research. On one such visit, while I was waiting to purchase my favourite Green Tea Creamy Cooler, I couldn’t help but notice four big letters on the payment terminal by the cashier counter. The word was “NERA” and I vaguely remembered always seeing this name at most payment systems in Singapore. Being curious, I googled “nera” to check if it was a company listed on any particular stock exchange, and yes, it was – NeraTel was listed right here on the Singapore Stock Exchange (SGX).

Nera Telecommunications Limited (SGX: N01) operates in 16 countries – including Singapore, Malaysia, China, India, Australia, Morocco and Norway – and offers a range of products and services in the areas of wireless infrastructure networks, satellite communications, network infrastructure and payment solutions. Of these business areas, NeraTel’s payment solutions business was the one that piqued my interest the most as I delved deeper into the company (you’ll soon find out why below).

As is our advice that we best attend the AGMs of the companies we invest in, I attended NeraTel’s most recent AGM in April looking for information that might give me an edge in my analysis of the company and I wasn’t disappointed to say the least.

So here are six quick things I learned from NeraTel’s AGM 2014:

1) NeraTel is a High Dividend-paying Company

Investors, in general, love high dividend stocks and NeraTel fits the bill.

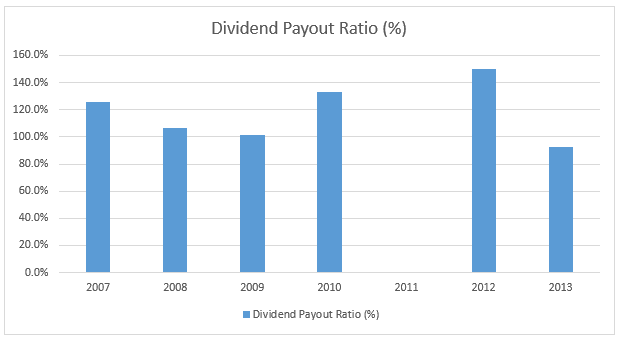

Except for 2011, NeraTel has a dividend payout ratio of 90% or higher from 2007 till now.

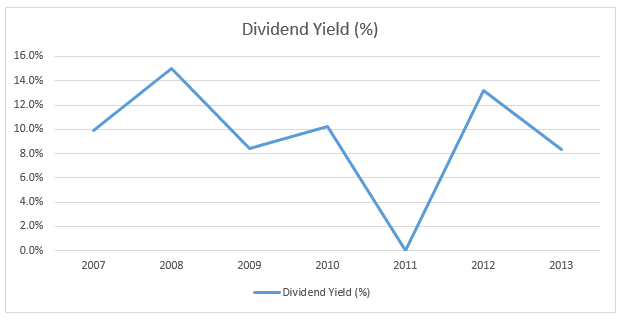

If you have bought NeraTel at any time from 2007-2013, you would have easily got a dividend yield of more than 8%. In comparison, the average dividend yield for the 30 component stocks in the STI over the last ten years is approximately 3%.

2) NeraTel’s Payment Solutions Business Segment is Growing

NeraTel’s payment solutions business segment (which account 21% of total revenue) is growing at 20%-30% per annum for the past 3 years. The reason payment solutions has been growing so fast is due to three things:

- a rise in debit and credit card spending

- government initiatives to go cashless

- banks outsourcing their point-of-sale infrastructure in order to focus on their core business activities.

When it comes to payment solutions, NeraTel offers their clients two options:

- NeraTel sells the point-of-sale (POS) terminals to their client and charges them recurring maintenance fees and percentage fees for every transaction made

- NeraTel leases the POS terminals to the client and charges them recurring rental fees, maintenance fees, and percentage transaction fees for every transaction made.

Either way NeraTel always nets a stream of stable, recurring revenue month after month, year after year. A company that has stable, recurring revenues that is highly predictable is hugely attractive to investors.

3) NeraTel is Increasing its Capital Expenditure (CAPEX)

As I mentioned above, companies with high, stable recurring revenues are hugely attractive to investors because of the predictability in their earnings. Because of that, the stock prices of these companies tend to trade at a premium and a higher P/E.

Currently, 21% of NeraTel’s revenue is recurring in nature and comes primarily from their payment solutions business. The company’s CAPEX is being used to increase the number of POS terminals in anticipation of expanding their payment solutions market share.

If the plan works out, NeraTel should see its overall revenue increase and, more importantly, theproportion of their recurring revenue as well, and we could see the stock slowly trading higher and higher.

4) NeraTel’s Payment Solutions are Easy to Scale

NeraTel’s POS terminals are all running on one base software they created themselves. It is extremely easy for the business to scale – they just need to add more POS terminals which connects to the same base software regardless of where the POS terminal is situated.

This means NeraTel can expand into different countries with the same set of terminals using the same software without having to create anything anew – saving a lot of time and money. This ease of expansion means the company can scale very quickly and potentially increase their revenue significantly over the next few years.

5) NeraTel’s POS Terminals Accept Both EZ-Link and NETS

NeraTel’s POS terminals in Singapore are the only ones that accept payment from both EZ-Link and NETS. Because of this convenience, we could see more merchants choose NeraTel over their competitors so as to provide more easy payment options for shoppers.

This slight competitive advantage could mean a lot to NeraTel in the long run especially if they establish themselves as the dominant player in the industry in Singapore.

6) Capital Restructuring is Highly Unlikely as of Now

A company like NeraTel is a good bet to undergo capital restructuring and include more debt financing in its capital structure because:

- Its revenue streams are increasingly becoming recurring in nature

- It has zero debt on its balance sheet

Debt financing has its advantages: a company can drastically increase its returns and ROE by using other people’s money (debt) to grow the business rather than using their own (equity). And as I wrote previously, a company with a higher ROE has a higher sustainable growth rate. But taking on too much debt can be risky. However for companies with stable, recurring revenues, the risk and debt obligations are more easily managed. Hence, NeraTel’s high potential to undergo a capital restructuring.

At the moment though, NeraTel is highly unlikely to do so because the company currently requires $20-$30 million in working capital and they cannot afford the capital reduction that a capital restructuring would bring.

Do you think that it's nearly impossible to double or triple your investment in blue-chip stocks? If you want the stability and security of a blue-chip company but are looking for the supercharged returns of smaller, high-growth stocks, then we want to tell you that it ispossible. In fact, we want to show you how we uncovered one company that's a market leader in its industry... but was still growing its revenues by up to 20.4% a year and its net profits by up to 39.8% a year! Click here to find out which company and download a FREE report that shows you how we made 243.5% returns in this "super" investment.

No comments:

Post a Comment