First let me say that I am one of Warren Buffett’s biggest fans and admirers. Studying his strategy of buying high good quality companies at huge discounts to intrinsic value has made me a lot of money in the last 10 years. He is known as the world’s greatest investor and has achieved an amazing track record. However, I have found that following his strategy ALONE can be very dangerous to most small time investors. Let me explain.

When Warren Buffet invests in a stock, he only focuses on the company’s fundamentals. This means that he looks for companies with a good business model, consistent earnings growth, competitive advantage, low debt and good management. He buys as long as the company’s current stock price is selling BELOW the true value of the stock (intrinsic value). He does NOT study the price pattern on the stock chart at all (known as technical analysis). He also does NOT take into account macroeconomic data like interest rates employment and inflation data.

Why does he do this? The reason is because when Buffett buys a stock, his minimum holding period is 10 years. So he does not care about the short and medium term trends that you can see from a stock chart. However, by using technical analysis, we can see if the stock price is on a downtrend or on an uptrend. When a stock is on an uptrend, it means the market psychology is optimistic and prices tend to move higher (upward momentum). When a stock is on a downtrend, it means the market is pessimistic and prices tend to go lower (downward momentum). The danger is that when a stock is on a downtrend, you do not know how low it can go. A cheap stock can become EVEN CHEAPER. In a downtrend, ALL stocks go down, both good and bad companies. No matter how good or cheap a stock is, a downtrend will always send it lower.

Warren Buffett does not take this into account at all. Can you follow his style? Yes! However, you may buy a stock on a downtrend that goes 20%-50% lower before eventually rising years later. If you are prepared to hold for 10 years and not less, then no problem. However, if you want to achieve higher returns in months and not 10 years, it makes sense to combine Buffett’s fundamental investing methods with technical analysis strategies used by other gurus like George Soros & Victor Sperandeo. Technical analysis helps you to better time your entry. While technical analysis is not 100% full-proof and while you can never buy right at the bottom and sell right at the top, it certainly improves your chances to buy NEAR the bottom, at the beginning of an uptrend and to sell NEAR the top, at the beginning of a downtrend.

When I started combining technical analysis strategies with Buffett’s value investing approach, I found that I have been able to make more money in a shorter period of time. At the same time, when stocks went on a downtrend, I was able to get out earlier and not see my investments fall 20%-60% before it would come back years later!

Let me give an example with a stock that has made me alot of money… Goodpack, listed in Singapore. Goodpack is a very good company that passes all of Buffett’s investment criteria (consistent earnings, low debt, competitive advantage, good management). This stock has an intrinsic value of $2.20+. In Wealth Academy, I teach my students how to determine intrinsic value using a discounted cash flow method.

Look at Chart X below. If you just purely use Buffett’s method of value investing (buying a good company when it is undervalued), you may have invested at point A, when the price is $1.60. It is definitely undervalued. However, what happened? 6 months later, the stock price went to $0.60 because of continued bad market sentiment. A cheap stock became EVEN CHEAPER! As a pure buffett follower, you would just hold for the long term. Sure enough, 1.5 years later, the price went back to $1.60. You had to wait 1.5 years just to break even!!! 6 months later, you would have made a profit when the price went to $2.20 (the intrinsic value). There is nothing wrong with this method except that it takes too long to make money.

CHART X

Now, look at Chart Y below. Using technical analysis, you would know that you should never buy on a downtrend. You must always wait for the price trend to REVERSE into an uptrend before buying. When a stock is on a downtrend, you never know how low it can go. This is driven by emotional psychology of fear and greed. A stock is on a confirmed downtrend when it breaks below the 200 Day moving average (the red line) and confirms a reversal into an uptrend when it subsequently breaks above the same 200 Day moving average.

CHART Y

If you had known this, you would never have bought at $1.60 when it was on a downtrend. You would wait for the trend to reverse into an uptrend and buy at the NEW POINT A, when the price is $1. Immediately you would have ridden the uptrend all the way up to the top at $2.30. You would have locked in profits and sold when the price cut the 200 day MA & reversed back into a downtrend at $1.90 (NEW POINT B). This would have given you a 90% return in just 15 months!

This is why in my Wealth Academy boot camp, I do not just teach Warren Buffett’s value investing strategy. Instead, Conrad and I teach our students ALL THE INVESTMENT STRATEGIES used by top investors & traders like George Soros, Victor Sperandeo, William O Neil, Philip Fisher and John Paulson. To be a successful investor, you have to learn fundamental analysis, technical analysis, Macroeconomics and sector rotation. When you combine the very best strategies of many investment experts, you take their best ideas and leave out their individual shortcomings.

Just to give you another example of why you should not follow Buffett’s methods blindly. In October 2008, He announced to the press that he was buying American stocks. What he did not know was that stocks were STILL ON A DOWNTREND.

What happened? Stock prices continued to decline 30% over the next 5 months!

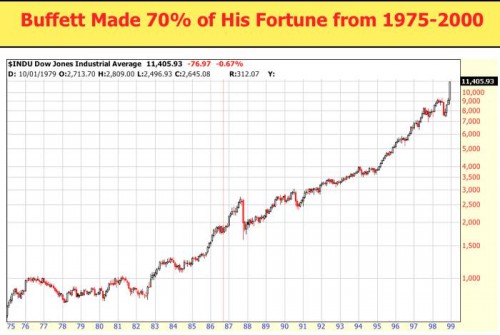

Another interesting point to note is that Buffett achieved his best stock market performance and made the majority of his money during the 1970s to 2000. At that time, the stock market was on a secular bull market with minor corrections along the way. See chart below.

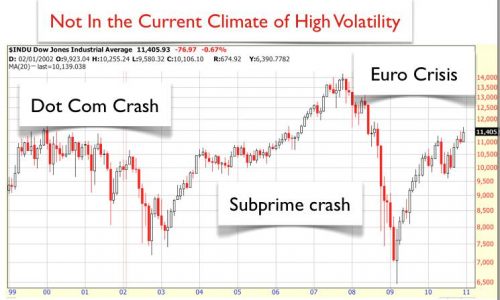

Dow Jones 2000-2011

If you were to just buy and hold over the last 10 years WITHOUT paying attention to the stock chart trends, you would have made only 20% return over 10 years. See chart Z below.

Chart Z

However, if you had entered ONLY during uptrends and exited when downtrends began, you would have made a 55% return in 4 years and another 20% return in 1 year. See chart M below.

Chart M

No comments:

Post a Comment